COVID-19 Insights: Beauty - May 2020

Analyze trends and changes in the Beauty landscape during the COVID-19 crisis.

Table of Contents:

About Us

Introduction

Key Takeaways

Lip Care Continues to Grow

Face Masks Bring Skin Concerns

Do It Yourself vs. On Premise Services

On Premise Services

Do It Yourself

Sun Care Continues to Grow

Shifts in WFH Conversations

Sustainability is Staying

The State of Self Care

Winning Brands in Beauty

Methodology

About Us

Social Standards is a comparative analytics platform transforming billions of social data points into benchmarked insights about every brand, product, feature, and trend consumers talk about. Innovative brands and investors use our data to make strategic decisions around product development, competitive differentiation, investments, and M&A opportunities so they can get ahead and stay ahead of the competition.

|

Introduction

The following report continues last month's investigation (see COVID-19 Insights: Beauty - Apr 2020) of the topics that have continued to trend amidst the COVID-19 outbreak and could be considered the new normal, and those that have fallen off.

Key Takeaways

Lip Care Continues to Grow

Lip care has continued to grow in Beauty over recent months, with products like lip exfoliant, lip oil, lip balms, and masks all on the rise. Consumer concerns around softening, moisturizing, dead skin, and soothing all seem to be driving some of overall lip care's recent growth.

Face Masks Bring Skin Concerns

As face masks seemingly become the new normal, skin concerns around breakouts, irritation, pimples, and acne are on the rise. Face masks may be irritating consumers' skin - as masks trap pores as well as the wearer's own breath - creating an environment that makes the wearer susceptible to these breakouts and irritation.

DIY vs. On Premise Services

While DIY saw significant growth during the pandemic, conversations about on-premise services are coming back. While consumers talk about returning to non-essential beauty businesses, many are still concerned with coronavirus.

Sun Care Continues to Grow

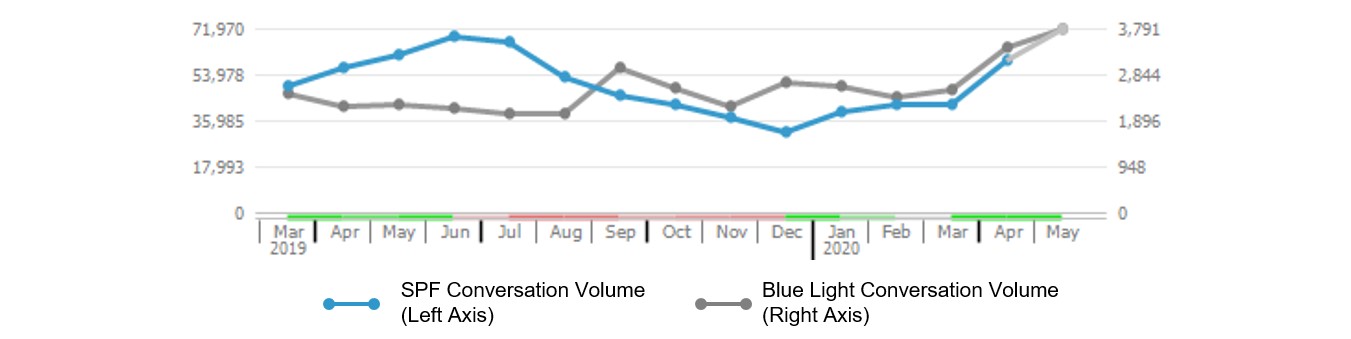

Sun care continues to grow despite the pandemic. While consumers are mostly still indoors, many cite blue light and skin cancer as motivators.

Shifts in Work From Home Conversations

Mentions of working from home have started to decline slightly in Beauty conversations on Instagram. Mentions of natural skin and healthy skin in Beauty-related WFH conversations have grown quickly over the past month, while mentions of blue light and SPF appear to be declining. While blue light and SPF are growing in Beauty overall, there seems to be a decrease in association with WFH specifically.

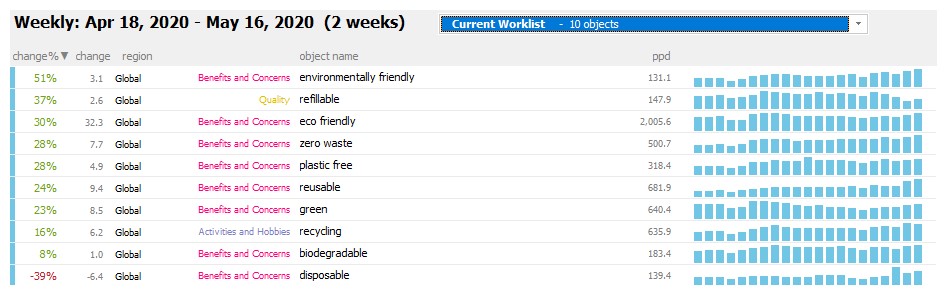

Sustainability is Staying

Eco-conscious topics are continuing to grow as we progress further in time. Temporarily overlooked at the start and height of the COVID crisis, as consumers settled in, sustainability efforts rebounded. Looking at recent weeks, it appears they're still on an upwards trend.

The State of Self Care

Self care continues to grow and be aligned with growing topics in Beauty. The majority of the most significant topics in self care conversations have seen consistent growth in overall Beauty conversations on Instagram. The brands highly associated with self care are also growing in Beauty - in fact, the relationship between brands' growth in self care and brands' growth in Beauty is incredibly linear, suggesting growth in self care equates to growth in Beauty.

Winning Brands in Beauty

When identifying which brands are most aligned with the top growing benefits & concerns in Beauty, Belif, The Inkey List, Supergoop, and Rodan + Fields are among the winners. These brands have had the fastest growing Beauty benefits & concerns throughout COVID driving their own conversations, as well as growing within.

Lip Care Continues to Grow

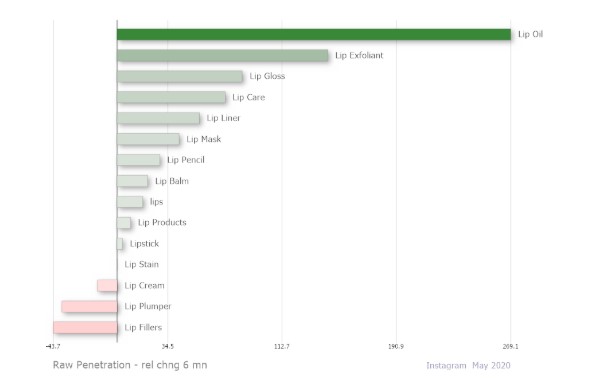

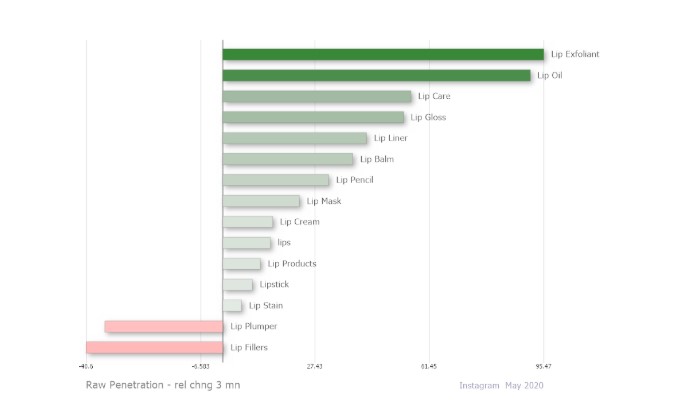

Since the beginning of the COVID-19 pandemic, the growth in lip products focused around lip care has dramatically increased in Beauty conversations. Consumers became increasingly concerned with lip health, prioritizing conversations about lip oil, lip exfoliant, lip care, lip masks, and lip balms.

| Lip Topics in Beauty conversations - 6 month change | |

| (bar color = red indicates decline, green indicates growth in lip care conversations over 6 months) |

| Lip Topics in Beauty conversations - 3 month change | |

| (bar color = red indicates decline, green indicates growth in lip care conversations over 3 months) |

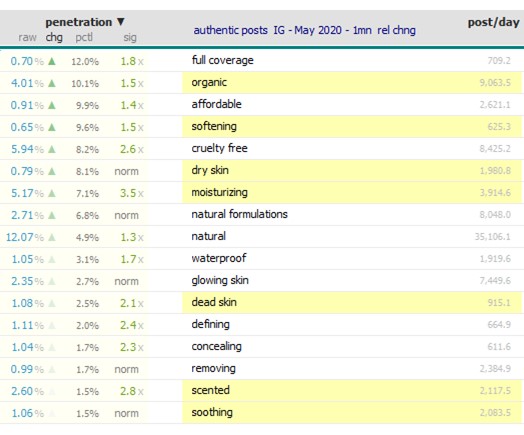

When looking at specific growing lip products as a whole (lip exfoliant, lip oil, lip gloss, lip care, lip liner, lip balm, and lip mask), terms such as organic, softening, moisturizing, dead skin, scented, and soothing appear to be driving some of overall lip care's recent growth.

| (Growth indicated by % 'chg' (1 month change), i.e. organic grew 12% over the last month) |

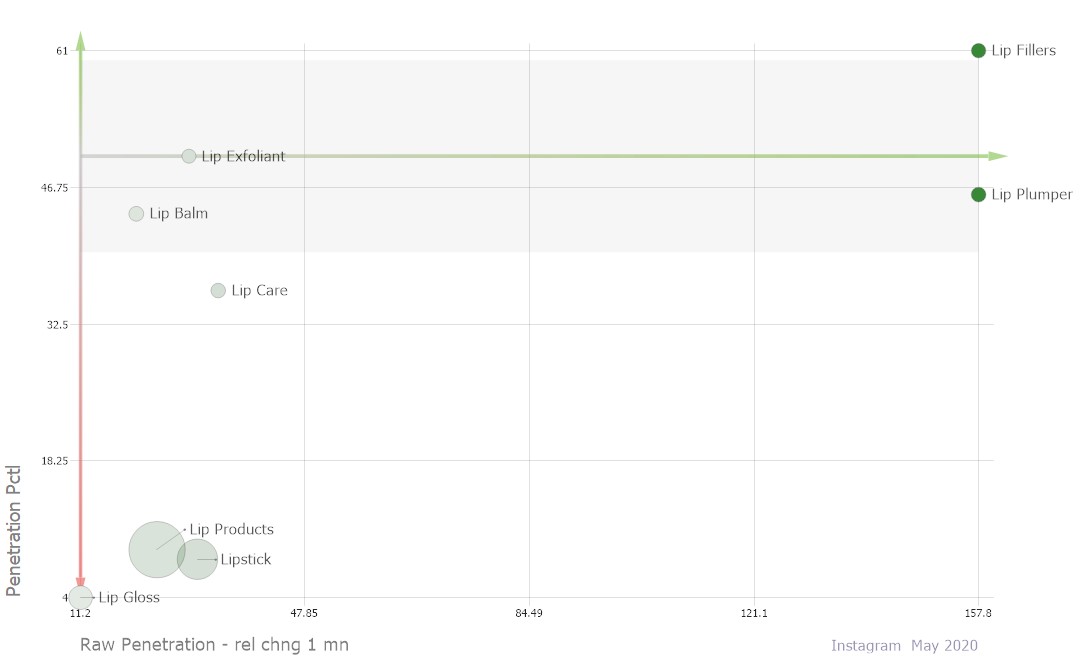

Lip products have seen small growth in face mask conversations, but still don't command much volume. The majority of lip products are mentioned at below normative rates in face mask conversations, suggesting the two don't have that large of an association. Lip fillers are the only product/service significant to face mask conversations, but that relationship is likely due to businesses opening back up and clients and doctors talking about new precautions during office visits and procedures.

| Lip Products in Face Masks conversations - 1 month change | |

| (x-axis = 1 month rate of change in face mask conversations, y-axis = strength of association with face masks, bubble size = topic size, bubble color = red indicates decline, green indicates growth in face masks over 1 month) |

Face Masks Bring Skin Concerns

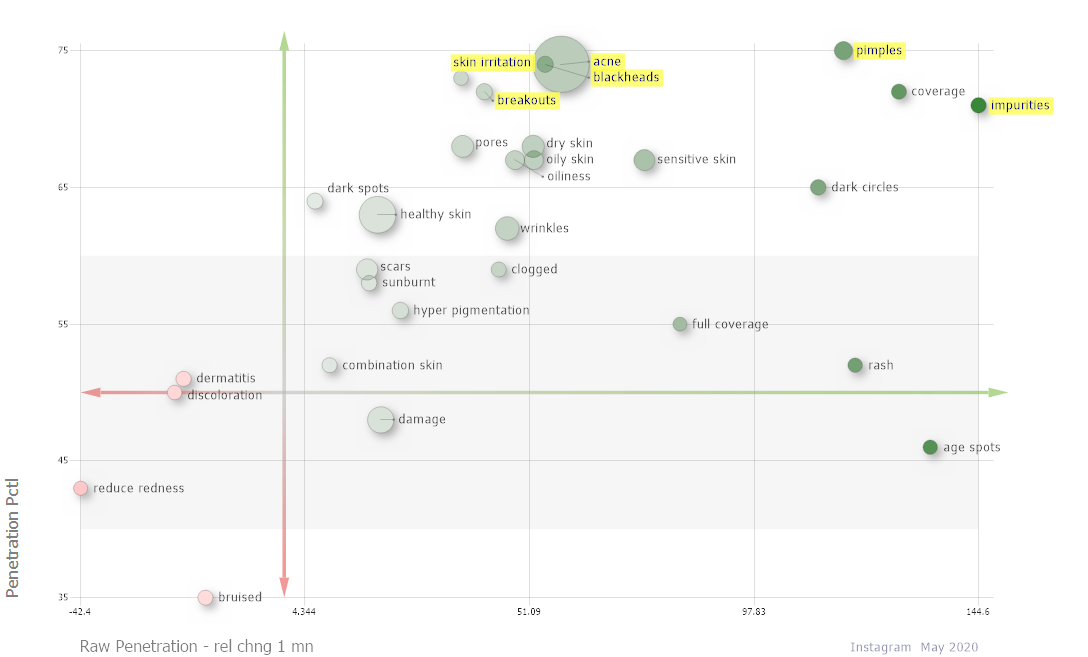

As states slowly start reopening, consumers are increasingly starting to go back out, with many of them wearing face masks to protect against the spread of COVID. With an increase in the use of face masks, consumers’ concerns over skin breakout, skin irritation, pimples, and acne are on the rise. Most skin concerns grew tremendously from April to May 2020.

| Appearance Concerns most Significant to Face Mask conversation - 1 month change (Non-essential businesses re-opening) | |

| (x-axis = 1 month rate of change in face mask conversations, y-axis = strength of association with face masks, bubble size = topic size, bubble color = red indicates decline, green indicates growth in face masks over 1 month) |

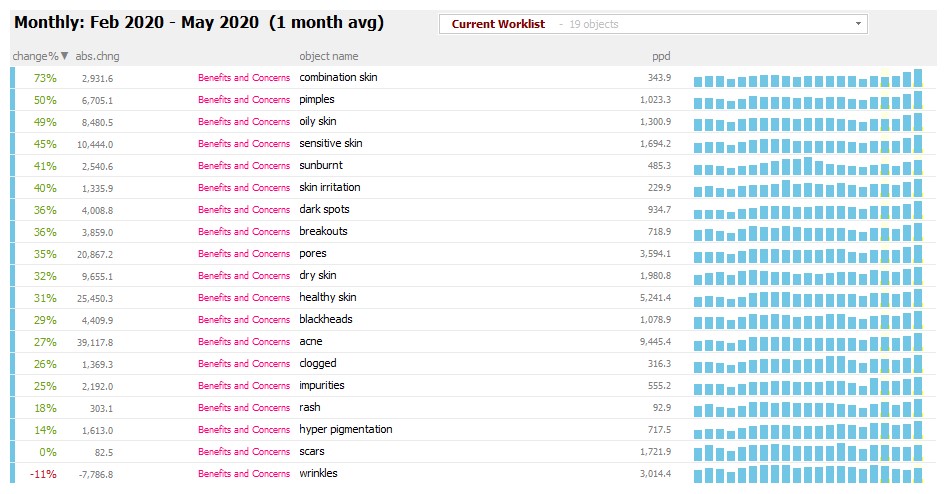

When taking only the significant and growing concerns in face masks conversations, we can see that in the Beauty category overall, almost all these concerns have also seen tremendous growth. Pimples, oily, sensitive skin, skin irritation, breakouts, acne, clogged, and rash have all grown quickly comparing February to May. It's likely the growing use of face masks is attributing to the rise in these skin concerns.

|

Do It Yourself vs. On Premise Services

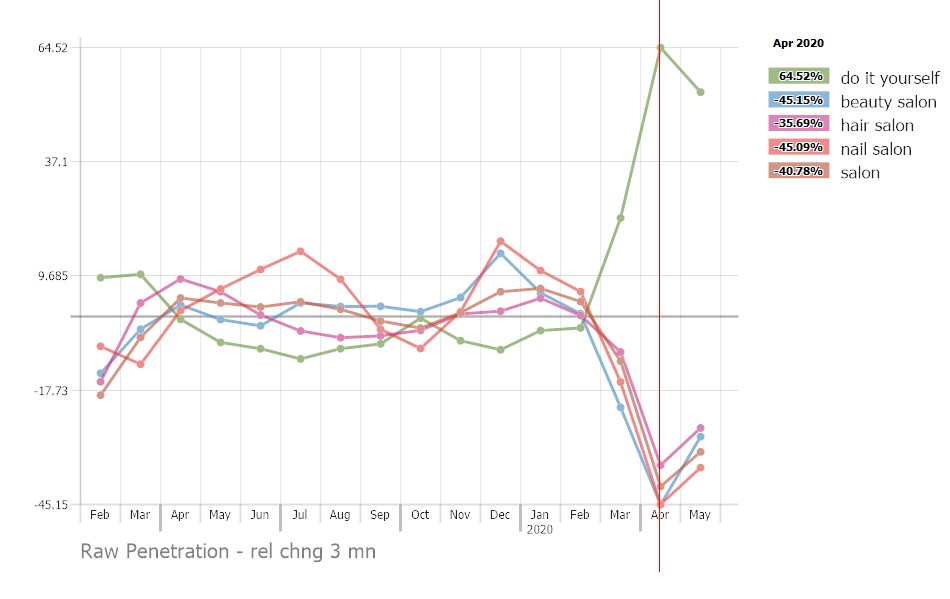

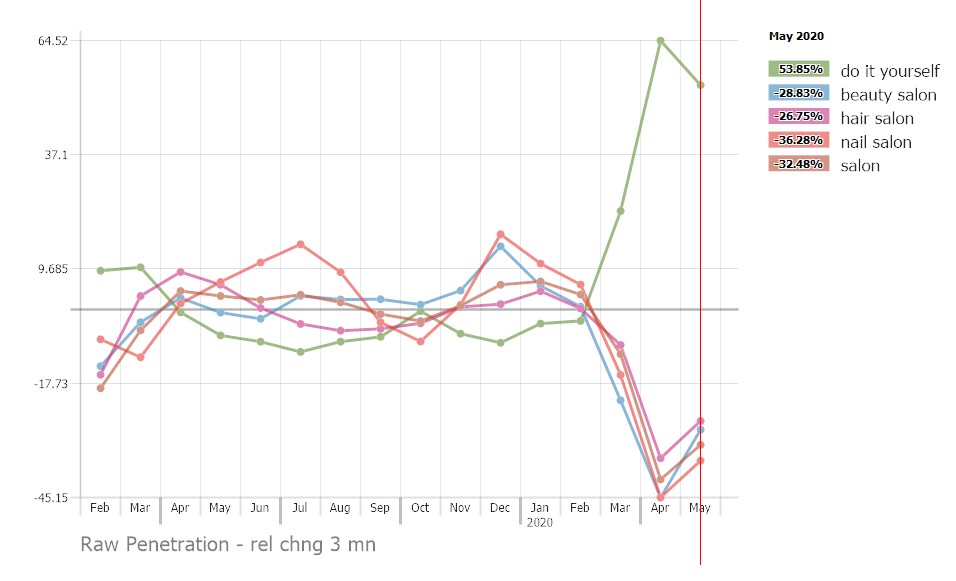

The graph below depicts how conversations about each topic have changed over a three month period. In April 2020, DIY conversations grew 64% since January. In May, DIY conversations grew 53% since February. We can clearly see the rise of DIY conversations during the COVID-19 pandemic, and the drastic decrease in conversations about beauty salons over the same time period. May conversations indicate an uptick in mentions about beauty salons and a slight decrease in DIY conversations as stay-at-home restrictions slowly loosen around the world.

| Plotted 3 month change of Raw Penetration for On premise services vs DIY in Beauty |

|

| Plotted 3 month change of Raw Penetration for On premise services vs DIY in Beauty |

|

On Premise Services

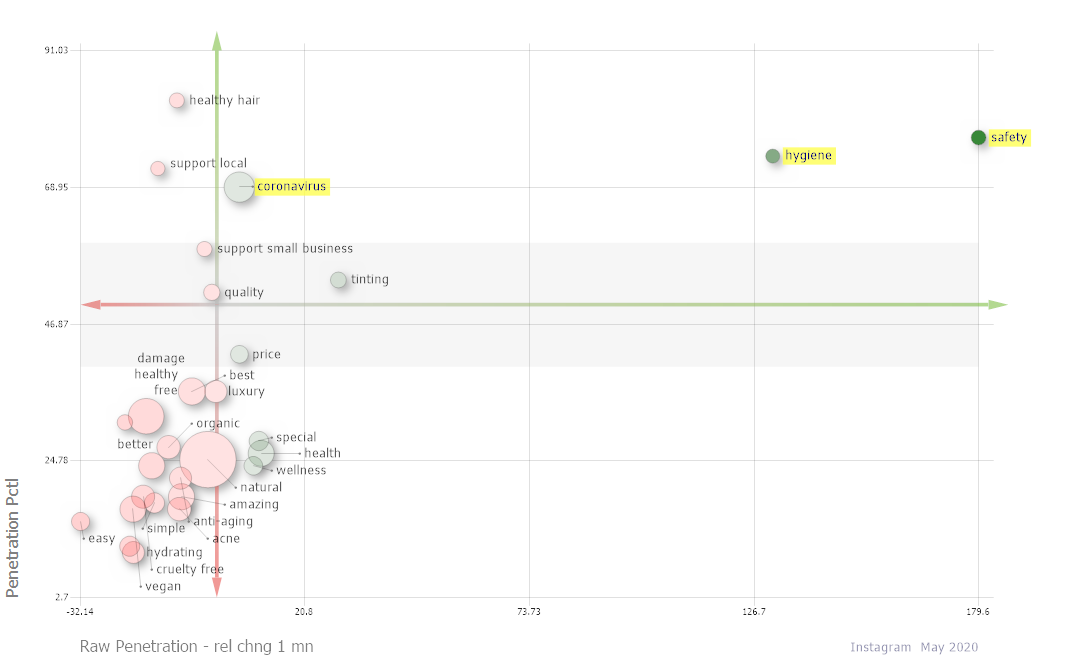

Looking at how conversations about salons have changed from April to May, we notice a growth in topics like safety, hygiene, and coronavirus - indicating that concerns over the pandemic are ever-present in consumer conversations, especially now that businesses are re-opening.

| Benefits and Concerns growing the most in Salon conversations in Beauty - 1 month change | |

| (x-axis = 1 month rate of change in salon conversations, y-axis = strength of association with salons, bubble size = topic size, bubble color = red indicates decline, green indicates growth in salon conversations over 1 month) |

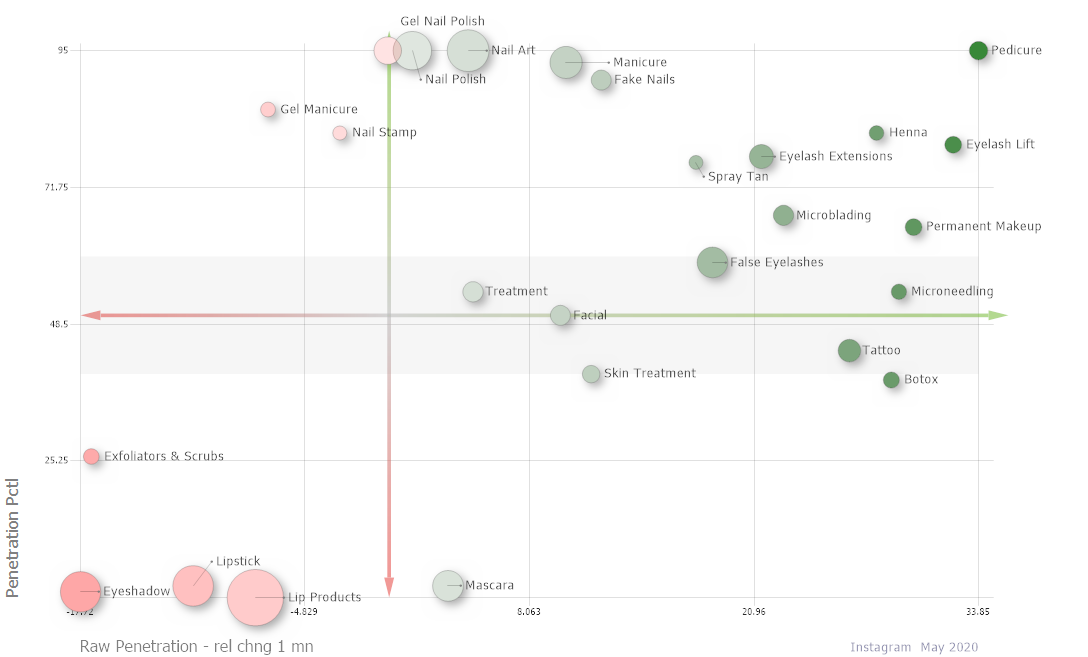

Conversations around beauty-related products and services have drastically changed over the past 3 months in salon conversations.

From April to May, we see a significant increase in nail products around pedicures and manicures as consumers return to salons.

| Products and Services most significant to Salon conversations in Beauty - 1 month change | |

| (x-axis = 1 month rate of change in salon conversations, y-axis = strength of association with salons, bubble size = topic size, bubble color = red indicates decline, green indicates growth in salon conversations over 1 month) |

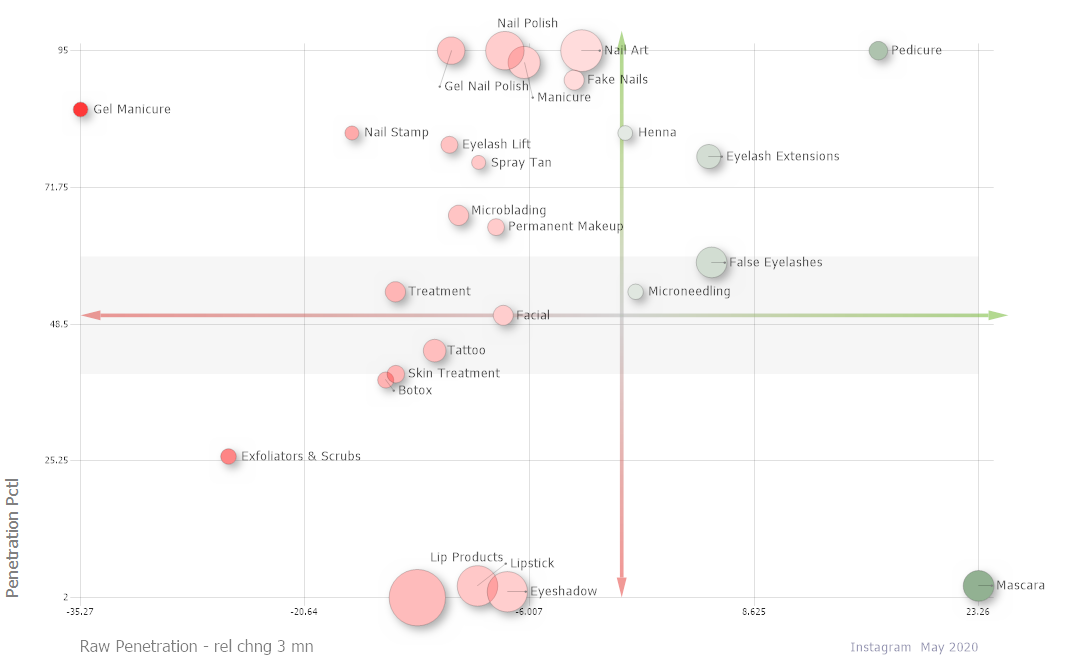

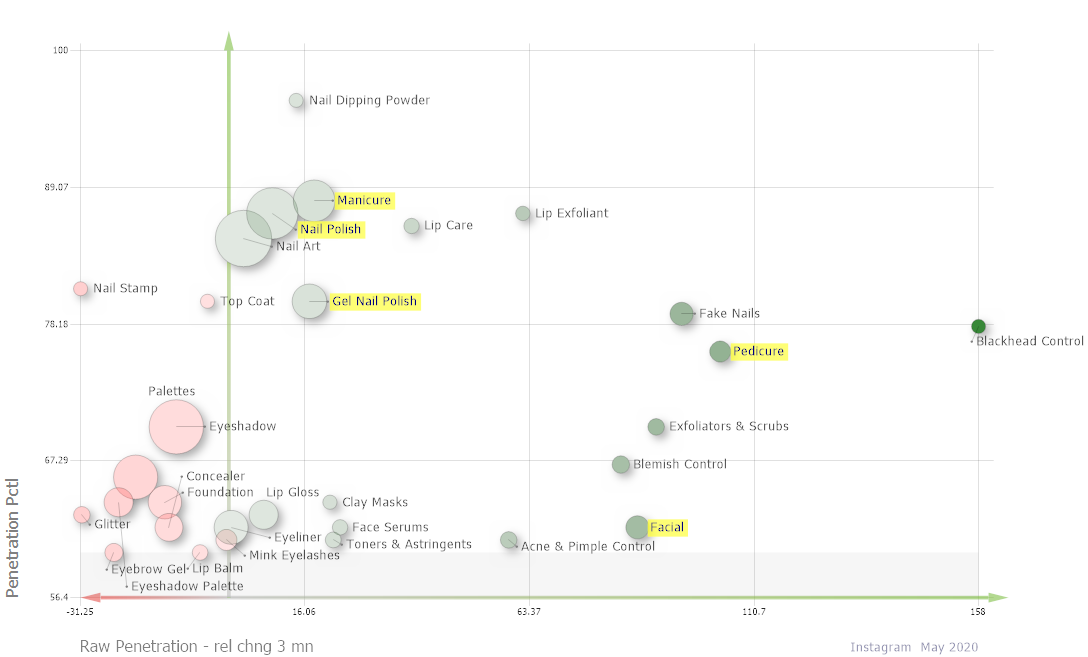

In contrast, comparing February to May, those same topics are declining due to beauty salons being closed, and consumers having to shift to DIY instead. Volume is increasing, but still haven't reached pre-COVID levels.

| Products and Services most significant to Salon conversations in Beauty - 3 month change | |

| (x-axis = 3 month rate of change in salon conversations, y-axis = strength of association with salons, bubble size = topic size, bubble color = red indicates decline, green indicates growth in salon conversations over 3 months) |

Do It Yourself

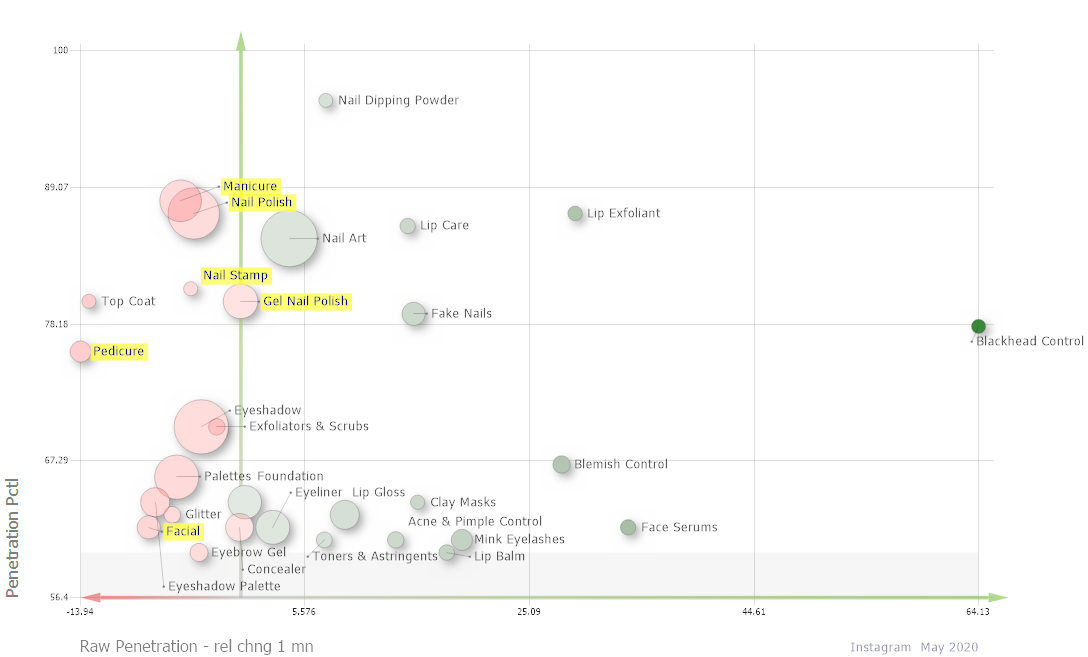

Topics like manicure and pedicure and those associated with nail products and services have all declined since April in Beauty conversations. As we see above, it looks like consumers are shifting from giving themselves manicures and pedicures at home to returning to salons.

| Products and Services most significant to DIY conversations in Beauty - 1 month change | |

| (x-axis = 1 month rate of change in DIY conversations, y-axis = strength of association with DIY, bubble size = topic size, bubble color = red indicates decline, green indicates growth in DIY conversations over 1 month) |

In contrast, manicures and pedicures were growing in DIY conversations during the pandemic as most non-essential businesses were closed in March and April.

| Products and Services most significant to DIY conversations in Beauty - 3 month change | |

| (x-axis = 3 month rate of change in DIY conversations, y-axis = strength of association with DIY, bubble size = topic size, bubble color = red indicates decline, green indicates growth in DIY conversations over 3 months) |

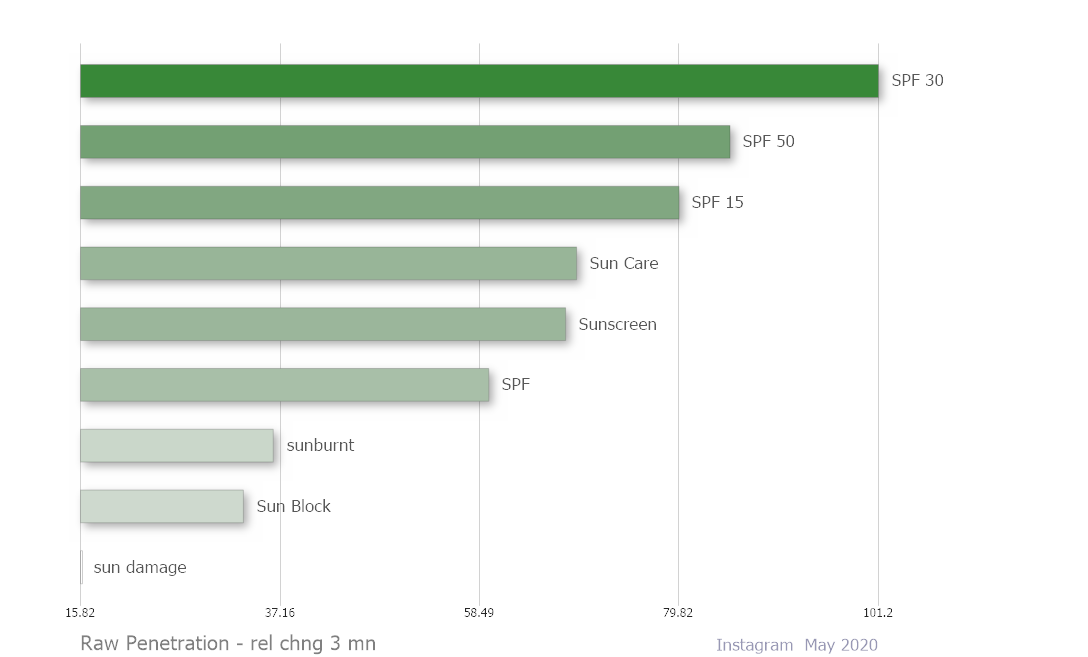

Sun Care Continues to Grow

Sun care topics like SPF 30, SPF 50, and SPF 15 continue to grow in Beauty, despite the COVID-19 pandemic.

| Sun Care topics growth in Beauty Conversation - 3 month change | |

| (bar color = red indicates decline, green indicates growth in sun care conversations over 3 months) |

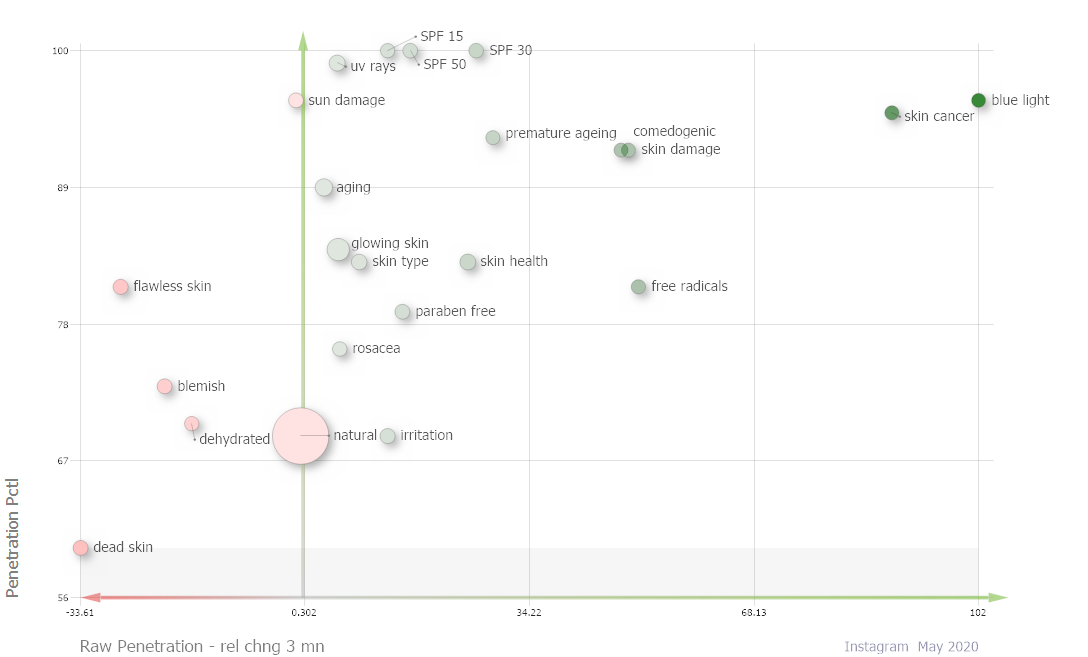

Consumers mention blue light and skin cancer as fastest growing concerns over the last 3 months.

| Most Significant Health Concerns to SPF conversations in Beauty - 3 month change | |

| (x-axis = 3 month rate of change in SPF conversations, y-axis = strength of association with SPF, bubble size = topic size, bubble color = red indicates decline, green indicates growth in SPF conversations over 3 months) |

Shifts in WFH Conversations

Comparing the two weeks ending on May 16, 2020 and the two weeks ending on February 15, 2020 (pre-COVID), working from home conversations relating to Beauty are up 450%. These appear to be going down however - comparing the recent two weeks with the two weeks ending on April 18, 2020, volume of WFH mentions show a 5% decrease.

|

|

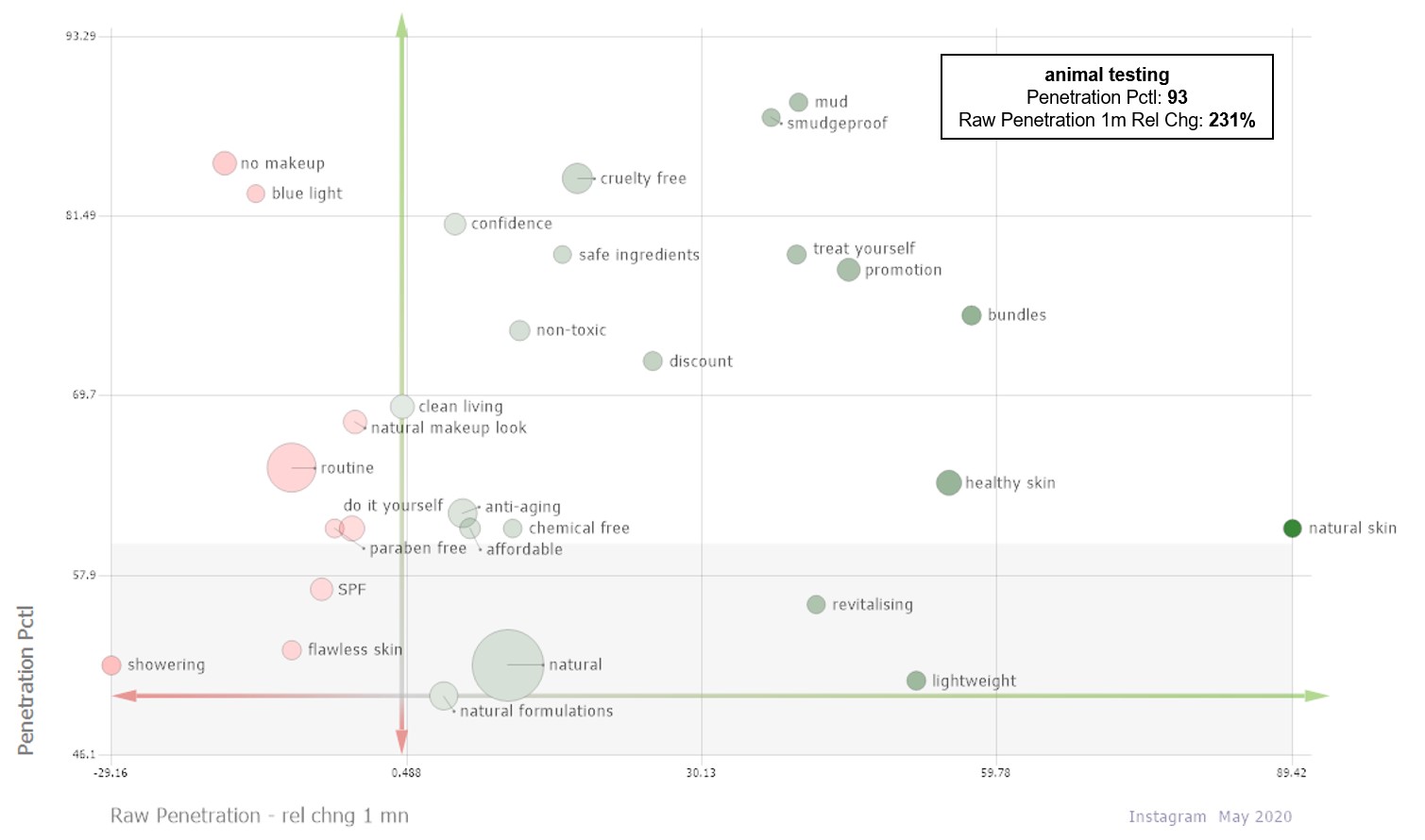

As another month of working from home passes, further shifts in Beauty emerge. Mentions of natural skin and healthy skin are among the fastest growing terms in Beauty-related WFH conversations between April and May of 2020. Cruelty free, animal testing and safe ingredients are also growing in these WFH conversations, signaling a rise in consumer attention on the products they use.

Month-over-month however, mentions of blue light (highly significant to WFH conversations) are decreasing, along with mentions of SPF. While this could be for many reasons, since blue light and SPF are both growing in Beauty overall, this seems to be a decrease in association with WFH specifically.

| Top 30 objects most significant to WFH in Beauty - Filter: Raw Pen >.25% | |

| (x-axis = 1 month rate of change in WFH conversations, y-axis = strength of association with WFH, bubble size = topic size, bubble color = red indicates decline, green indicates growth in WFH conversations over 1 month) |

|

Sustainability is Staying

Eco-conscious topics continue to grow as consumer focus moves even further away from disposables. Environmentally friendly, refillable, zero waste, and plastic free have all increased in mentions within Beauty conversations in recent weeks.

| Selected Sustainability terms comparing % change between 2 weeks ending on Apr 18, 2020 and 2 weeks ending on May 16, 2020 |

|

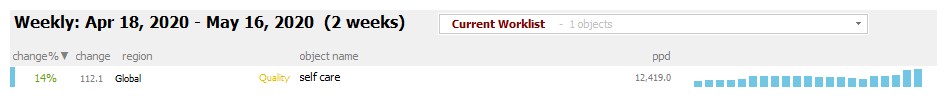

The State of Self Care

Self care's share of Beauty is projected to fall slightly in May, after seemingly reaching its peak in April. Its share of Beauty conversations was at around 2.15% in April, and is projected to have around 2.09% of Beauty conversations in May. Rather than self care itself decreasing in volume, it appears its slight decrease is perhaps due to an influx in Beauty conversations.

Comparing the volume of self care conversations between the two weeks ending on May 16 and the two weeks ending on April 18 however, self care is still up 14%.

|

|

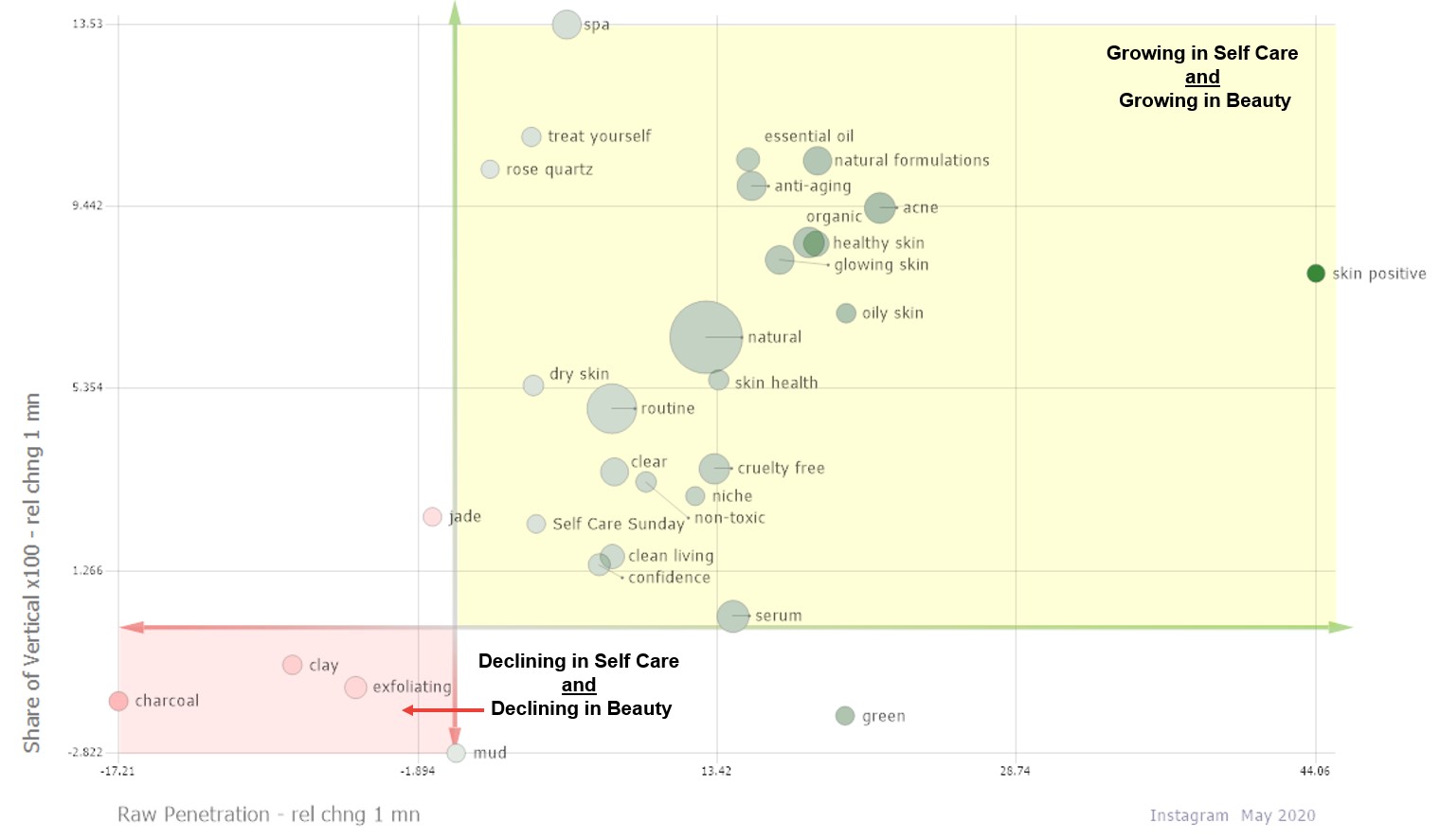

Self care continues to be aligned with recently growing topics in Beauty overall, likely attributing to its own growth. When looking at the top significant terms in self care conversations, the vast majority (upper right quadrant) are both growing within self care and growing within Beauty over the past month. This contains terms such as skin positive, healthy and glowing skin, natural formulations, and anti-aging.

| Top 30 objects most significant to Self Care in Beauty - Filter: Raw Pen >.25% | |

| (x-axis = 1 month rate of change in self care conversations, y-axis = 1 month rate of change in share of Beauty conversations, bubble size = topic size, bubble color = red indicates decline, green indicates growth in self care conversations over 1 month) |

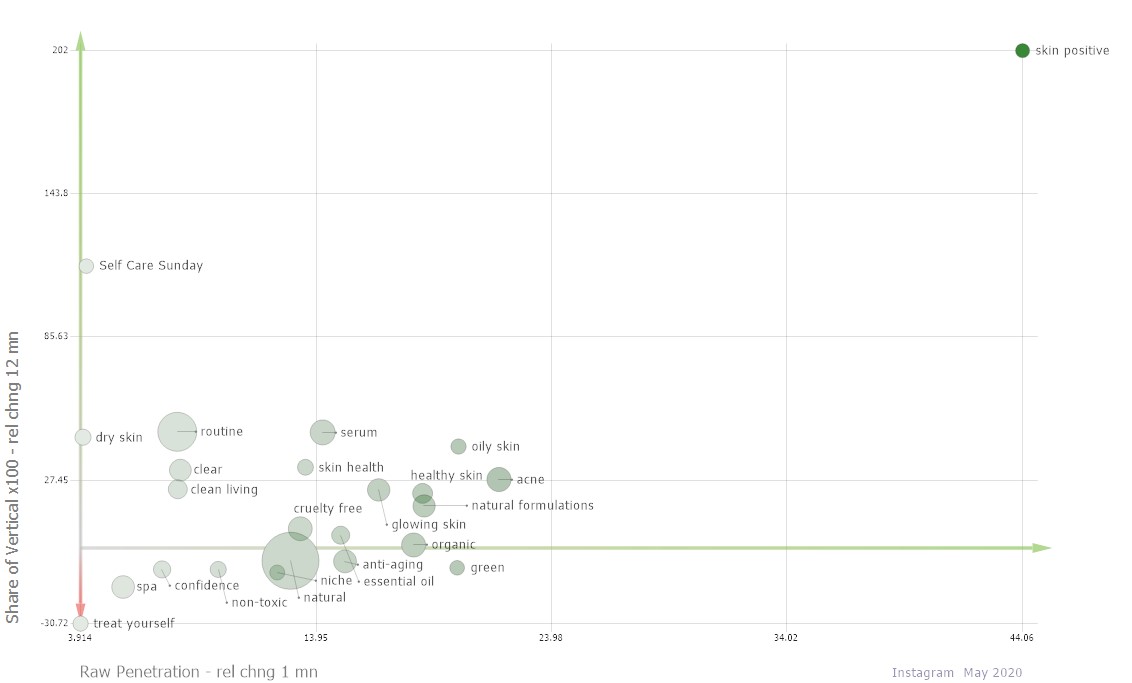

Many of the terms growing in self care conversations have also had long term growth in Beauty - skin positive is one of the fastest growing terms in Beauty and it's also among the fastest growing terms in self care recently. Self care's alignment with Self Care Sunday is solid, as Self Care Sunday has grown YOY in Beauty, along with terms like routine, serum and skin health.

Treat yourself, spa, and confidence have declined in overall Beauty conversations YOY but have grown recently in self care conversations. These may be emerging associations with self care among consumers.

| Top 30 objects most significant to Self Care in Beauty and Growing (from previous chart) | |

| (x-axis = 1 month rate of change in self care conversations, y-axis = 12 month rate of change in share of Beauty conversations, bubble size = topic size, bubble color = red indicates decline, green indicates growth in self care conversations over 12 month) |

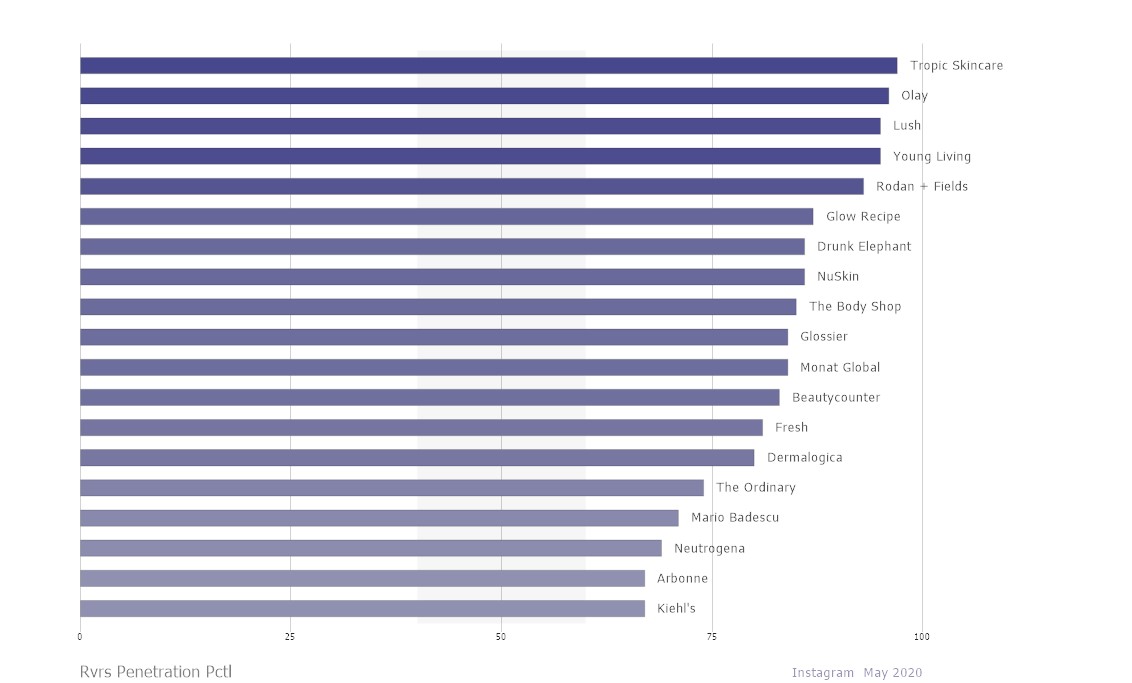

The brands in which self care drives the conversations are mostly skincare-focused brands.

|

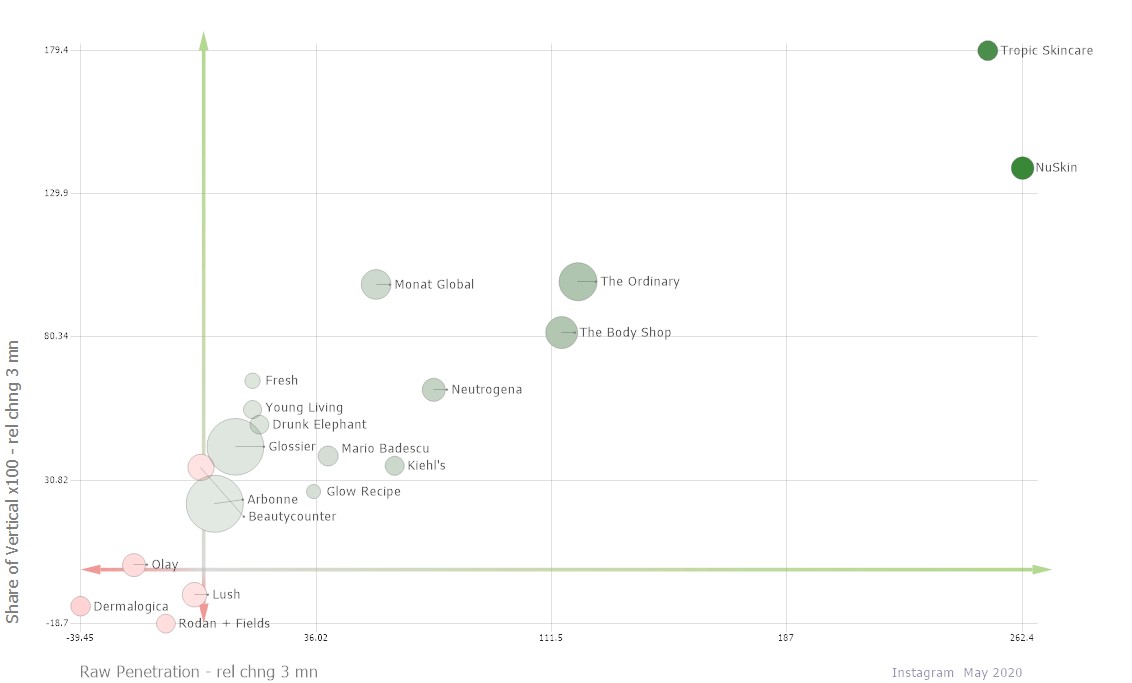

Comparing February (pre-COVID) to May, the majority of these self care-integral skincare brands are growing in self care conversations and Beauty overall. This seemingly linear relationship also suggests that growth in self care continues to equate to growth in Beauty.

| (x-axis = 3 month rate of change in self care conversations, y-axis = 3 month rate of change in share of Beauty conversations, bubble size = topic size, bubble color = red indicates decline, green indicates growth in self care conversations over 3 months) |

Winning Brands in Beauty

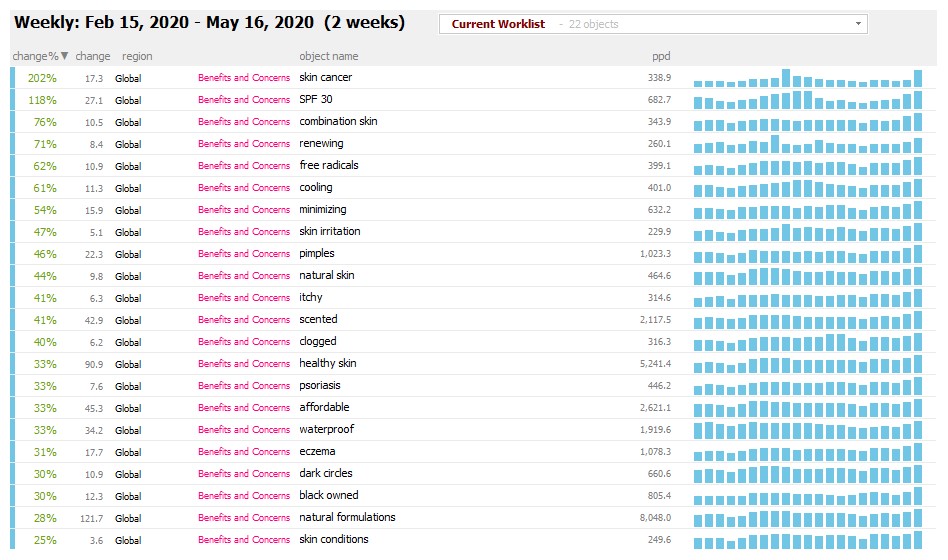

The below terms include all high volume benefits/concerns with >25% growth in two separate time periods - one comparing the two weeks ending on May 16, 2020 and the two weeks ending on February 15, 2020 (pre-COVID), and another comparing two weeks ending on May 16, 2020 and the two weeks ending on April 18, 2020. This was a way to measure which Beauty concerns that have grown since pre-COVID have sustained their growth in most recent weeks/months.

|

|

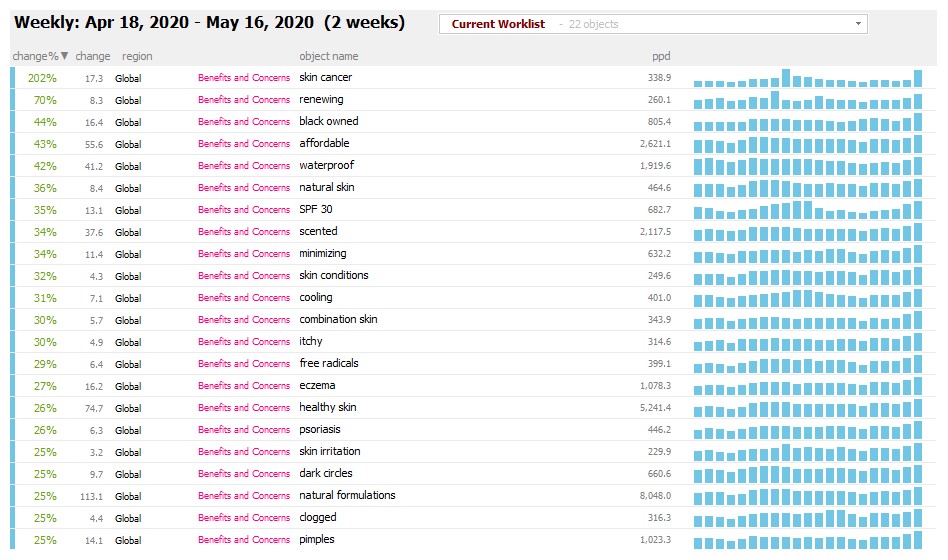

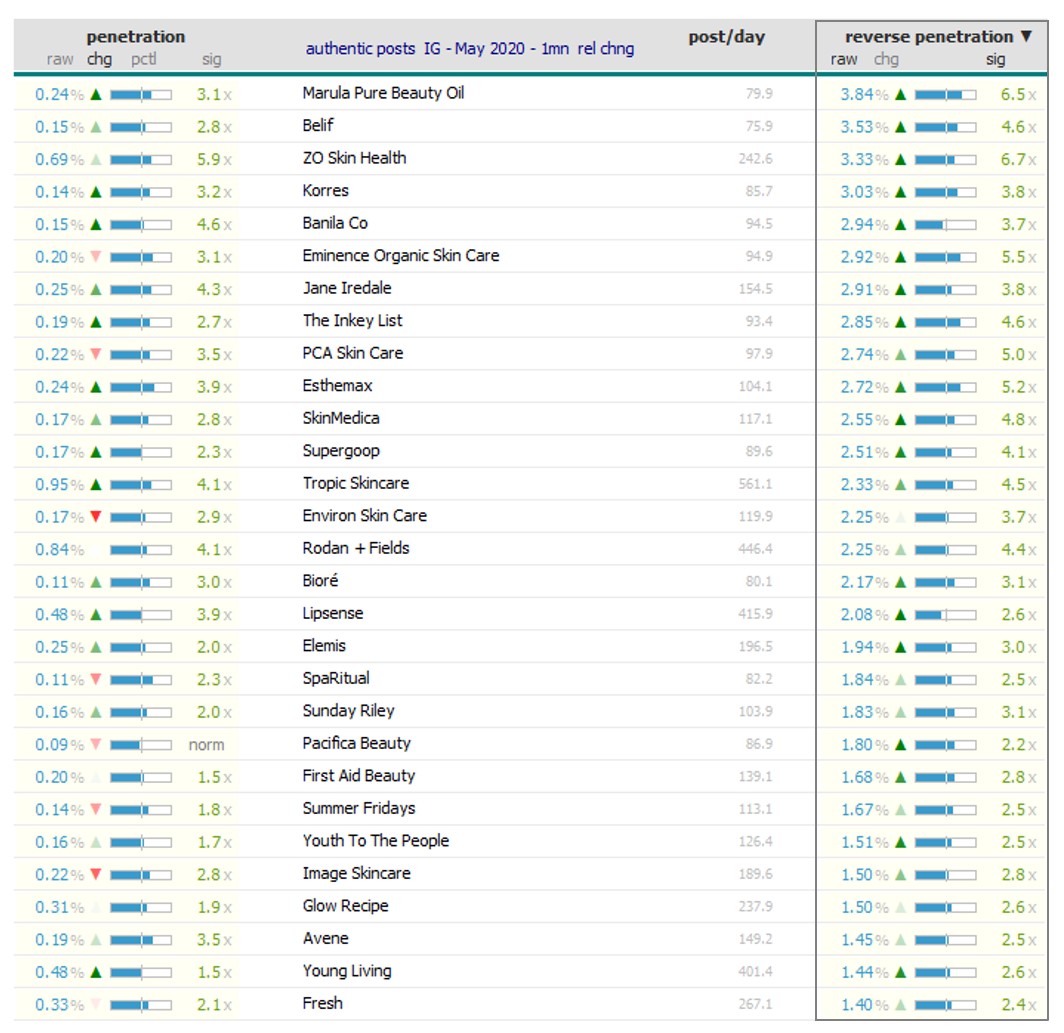

The following brands have these growing Beauty benefits & concerns most integral to and growing within their conversations. Belif, The Inkey List, Supergoop, and Rodan + Fields are among the brands in which the fastest growing benefits & concerns in Beauty throughout COVID are driving their conversations. These growing benefits & concerns in overall Beauty have also been growing within these brands recently.

|

Methodology

To provide our clients with the latest insights, our proprietary platform collects, analyzes, and benchmarks social data. Here’s what that process looks like:

|

for more on methodology Click Here if you have additional questions, please email Jordan Breslauer

2015-2021 © by Social Standards, Inc.

last updated on Jun 02, 2020

Object IDs successfully added to clipboard