Hard Seltzer Going Global?

The Hard Seltzer hype is here to stay in the US - conversation volume is nearly comparable to its position last summer. Additionally, it appears that this hype is no longer concentrated in the United States and Hard Seltzer conversation is taking off globally.

Non-Alcoholic Back on Track

With the initial stress and uncertainty of the pandemic, conversations around non-alcoholic and sober curious took a dip. Now that things have settled, these topics have bounced back and consumers appear to be associating these topics with mental and physical health concerns.

Alcohol Delivery

Delivery conversations have declined slightly, potentially due to bars and restaurants beginning to reopen. Some product types, like Prepared Cocktails, have a greater reliance on delivery than others and thus will be more greatly impacted if consumers return to prior levels of on-premise consumption.

The 'New Normal'

Consumers are increasingly talking about 'the new normal' post quarantine. In these conversations, consumers mention topics related to going out, dining out, clubbing, and nightlife, reflecting on regulatory changes to previous experiences and occasions.

Let's Have a Picnic

As summer is in full force and outdoor dining options are limited, picnics have taken off. Wine appears to be the alcoholic beverage of choice for these occasions.

Changing Bar Scene

Consumers talking about bars appear less afraid and more excited. Many of the locations growing in association with Bar conversation are those with outdoor offerings such as rooftop bar and beer garden. Additionally, as sports leagues are preparing to play again, Sports Bar conversations are slowly beginning to rise.

Hard Seltzer may no longer be deemed a fad. Not only did it reach conversation levels equivalent to those at the height of summer last year, but it is projected to continue growing. This year versus last year, Hard Seltzer conversations were higher and displayed more steady growth, indicating that consumer interest outlived seasonal hype and adapted to the unexpected complications arising from COVID-19.

|

| Trended Conversation Volume of Hard Seltzers (Global) |

|

Some of this growth is coming from B outside the US, where Hard Seltzers were almost unknown until early 2020. In regions outside the US, Hard Seltzer conversations escalated beginning in March, and have grown quite rapidly into June and July. Although volumes are still small compared to the US, there seems to be growing popularity of Hard Seltzers globally this summer.

|

| Trended Conversation Volume of Hard Seltzers (USA) |

|

|

| Trended Conversation Volume of Hard Seltzers (Non-USA) |

|

Shown in the graphic below are key benefits & concerns mentioned in Hard Seltzer conversations. While over-indexing topics related to weight loss and diet such as low carb, keto, calories and weight loss are losing share of Hard Seltzer conversations, general health & wellness related topics like vegan, healthy, organic, nutrition and wellness are driving growth in the category. Support local and support small businesses have also grown immensely in mentions alongside Hard Seltzer -- these topics have been gaining traction across verticals over the past year, which suggests Hard Seltzers are well-aligned with overarching trends in the market.

| | X-axis: | | Raw Penetration - rel chng 12 mn | | How have these benefits & concerns grown or declined in Hard Seltzer conversations? | |

| | Y-axis: | | Penetration Pctl | | Are these benefits & concerns over or under represented in Hard Seltzer conversations relative to Beverage Alcohol? | |

| | Circle Color: | | Raw Penetration - rel chng 12 mn | | How have these benefits & concerns grown or declined in Hard Seltzer conversations? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the topic | |

White Claw still owns the category and appears in 61.8% of all Hard Seltzer conversations. However, its share has declined on an YoY basis. Truly and Bud Light Seltzer are the 2nd and 3rd largest brands.

Among the next tier of players appearing in around or less than 2% of Hard Seltzer conversations, High Noon has been the winner over the past few months, exceeding Corona Hard Seltzer in July.

After taking a dip at the beginning of the COVID-19 crisis, Non-Alcoholic is back on track with consistent growth. Non-Alcoholic has grown 22% YoY (comparing May-Jul 2019 to May-Jul 2020), and the conversation volume around the category in July was almost at the level it was in January, when Non-Alcoholic conversations jumped in association with New Year's resolutions.

|

| Trended Conversation Volume of Non-Alcoholic (Global) |

|

Topics related to Non-Alcoholic including alcohol free, sober curious and sober have also been showing a similar trend. With pandemic-related stress easing, consumers seem to be returning to their pre-COVID mindset and refocusing on secondary lifestyle based concerns.

The graphic below shows fastest growing topics in Non-Alcoholic conversations. Consumers seem to be enjoying homecooked meals along with their Non-Alcoholic drinks. Moreover, there is a growing association of Non-Alcoholic beverages to mental and physical health.

| | X-axis: | | Raw Penetration - rel chng 12 mn | | How have these topics grown in Non Alcoholic conversations over the past year? | |

| | Y-axis: | | Raw Penetration - rel chng 6 mn | | How have these topics grown or declined in Non Alcoholic conversations over the past 6 months? | |

| | Circle Color: | | Raw Penetration - rel chng 12 mn | | How have these topics grown in Non Alcoholic conversations over the past year? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the topic | |

Delivery conversations have declined slightly after peaking in April, but are still more voluminous than before the COVID-19 crisis.

|

| Trended Conversation Volume of Delivery |

|

The graphic below shows Beverage Alcohol products that appear in at least 1% of Delivery conversations, and have Delivery integral to their conversations. Delivery is becoming more popular within all of these products' conversations, and it is growing fastest within the context of Aperitifs.

| | X-axis: | | Rvrs Raw Penetration - rel chng 12 mn | | How has Delivery grown or declined in these products' conversations? | |

| | Y-axis: | | Rvrs Penetration Pctl | | Relative to Beverage Alcohol, is Delivery over or under represented in these products' conversations? | |

| | Circle Color: | | Rvrs Raw Penetration - rel chng 12 mn | | How has Delivery grown or declined in these products' conversations? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the topic | |

Although Prepared Cocktails appear in only 0.23% of Delivery conversations, Delivery is quite integral to this product category -- Delivery's share of Prepared Cocktails conversations reached 23.8% in May, and it still appears in more than 12% of their conversations.

|

| Trended Performance of Delivery in Prepared Cocktails Conversations |

|

Shown below are cocktail preparations mentioned in at least 0.5% of Delivery conversations, and their growth within Delivery over the past year. The majority of these cocktails have increased in mentions alongside Delivery, led by Classic Cocktails, Sour Cocktails and Vodka Cocktails. Shots, Mocktails and Beer Cocktails have lost share year-over-year.

| | X-axis: | | Raw Penetration - rel chng 12 mn | | How have these preparations grown or declined in Delivery conversations? | |

| | Y-axis: | | Raw Penetration | | How frequently are these preparations mentioned in Delivery conversations? | |

| | Circle Color: | | Raw Penetration - rel chng 12 mn | | How have these preparations grown or declined in Delivery conversations? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the topic | |

As consumers have realized their adjustments to life amidst the global pandemic may not be temporary, the new normal has continued to grow in conversation volume.

|

| Trended Conversation Volume of 'New Normal' (Global) |

|

Key topics in the new normal conversations revolve around going out. People may be reflecting on their adjustments to nightlife in the pandemic era. In particular, their drinking locations have shifted towards those that are outdoors - beer garden, rooftop bar, and rooftop highly over-index.

Furthermore, the activities and hobbies that grew the most over the last 3 months in the new normal conversations are going out, dining out, clubbing, and nightlife (as indicated by bar color). As bars and restaurants have begun adhering to safety guidelines and reopening, consumers have expressed an increased interest in these activities. This could be indicative of the desire to do whatever it takes to socialize after months of being inside or of increasing fear around participation in these activities.

The time & events greatly contributing to the overall growth in the new normal conversations are reopening and night out - growing over 350% over the last 3 months. Other topics revolve around positive alternative ways to socialize, such as family time, picnic and girls night.

| | X-axis: | | Raw Penetration - rel chng 3 mn | | How have these time & events grown or declined in 'the new normal' conversations? | |

| | Y-axis: | | Raw Penetration | | How frequently are these time & events mentioned in 'the new normal' conversations? | |

| | Circle Color: | | Raw Penetration - rel chng 3 mn | | How have these time & events grown or declined in 'the new normal' conversations? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the topic | |

Over the past few months, picnic has grown significantly in hanging out conversations. As summer is in full force and there are limits to outdoor dining and other activities, consumers are getting creative.

|

| Hanging Out in Picnic Conversations Trended (Global) |

|

In picnic conversations, wine is the most over-indexed product category and continues to grow. But, non-alcoholic is growing slightly faster, perhaps as individuals attempt to moderate their consumption for health or practical purposes.

| | X-axis: | | Raw Penetration - rel chng 3 mn | | How have these product categories grown or declined in picnic conversations? | |

| | Y-axis: | | Raw Penetration | | How frequently are these product categories mentioned in picnic conversations? | |

| | Circle Color: | | Raw Penetration - rel chng 3 mn | | How have these product categories grown or declined in picnic conversations? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the Topic | |

Bar conversation volume has slowly started to pick back up after dropping significantly in April during business closures.

|

| Trended Conversation Volume of Bar (Global) |

|

Over the last 3 months, consumers appear less fearful and more excited in their associations with bars. They are remaining cautious but appear to be making their way back into socializing.

| | X-axis: | | Raw Penetration - rel chng 3 mn | | How have these state of minds grown or declined in bar conversations? | |

| | Y-axis: | | Raw Penetration | | How frequently are these state of minds mentioned in bar conversations? | |

| | Circle Color: | | Raw Penetration - rel chng 3 mn | | How have these state of minds grown or declined in bar conversations? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversation related to the topic | |

As previously seen in 'the new normal' conversations, outdoor locations are growing in bar conversations. In particular, there's a rising interest in beer gardens, a location with wide variety and outdoor enjoyment opportunity.

Since the initial outbreak, home bar conversations have started to decline, but remain higher than before the crisis began.

|

| Trended Conversation Home Bar (Global) |

|

With many sporting events put on pause, sports bar conversations took a hard hit. As some leagues are in prepare to play again, the topic is showing some minimal growth.

|

| Trended Conversation Volume of Sports Bar (Global) |

|

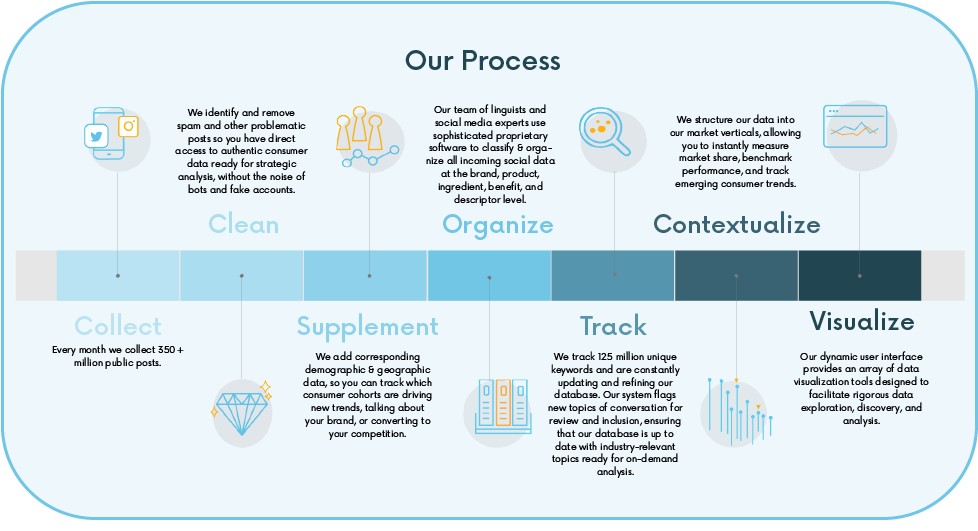

To provide our clients with the latest insights, our proprietary platform collects, analyzes, and benchmarks social data. Here’s what that process looks like:

2015-2021 © by Social Standards, Inc.

last updated on Aug 18, 2020