COVID-19 Insights: Beauty - April 2020

Analyze trends and changes in the Beauty landscape during the COVID-19 crisis.

Table of Contents:

About Us

Key Takeaways

Replacing On-Premise Services

WFH, Netflix and Beauty

Rebound of Environmental Concerns

Anxiety, Mental Health and Stress Relief

Self Care Continues to Rise

Products/services

Brands

Ingredients

SPF

Methodology

About Us

Social Standards is a comparative analytics platform transforming billions of social data points into benchmarked insights about every brand, product, feature, and trend consumers talk about. Innovative brands and investors use our data to make strategic decisions around product development, competitive differentiation, investments, and M&A opportunities so they can get ahead and stay ahead of the competition.

|

Key Takeaways

On-Premise Beauty Services

On-premise beauty services are being replaced by products accessible at home: false eyelash consumers are shifting to mascara, eyebrow tinting to eyebrow pencil, and botox to skincare.

WFH & Netflix

As companies and employees continue to hold meetings virtually, there is still motive or interest in looking more put together and “ready” for work. While looking natural and polished is more important to work from home, no makeup and self care skew towards Netflix.

Eco-Consciousness

After a short decline at the beginning of the pandemic, eco-conscious topics are rebounding.

Anxiety, Mental Health & Stress Relief

Conversation growth around anxiety, mental health and stress relief have slowed down, but these topics are still up.

Self Care

Interests around self care are at an all time high. Skincare products are becoming more relevant to self care, whereas services are down.

SPF

SPF has grown in Beauty conversations YoY, suggesting better education around the benefits of SPF among consumers. Blue light is the benefit leading growth in the category.

Replacing On-Premise Services

The false eyelash consumer is becoming more of a mascara consumer while the mascara consumer is becoming less of a false eyelash consumer over the last 3 months.

|

The eyebrow tinting consumer is becoming more of an eyebrow pencil consumer while the eyebrow pencil consumer is becoming less of an eyebrow tinting consumer.

|

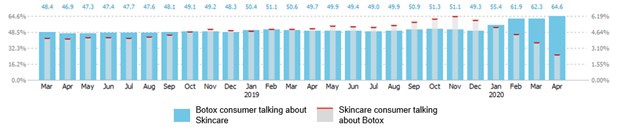

The Botox consumer becoming more of a skincare consumer while the skincare consumer becoming less of a botox consumer.

|

WFH, Netflix and Beauty

Skincare is especially prevalent in working from home conversations in Beauty and has grown since the start of COVID-19. As companies and employees continue to hold meetings virtually, there is still motive or interest in looking more put together and “ready” for work. Subtle makeup like BB cream, mascara, foundation, blush and lipstick all are growing in working from home conversations. Eyeshadow, highlighter and contour, used to create more dramatic makeup looks, are all insignificant to working from home conversations, as well as declining in mentions within Beauty generally.

|

Comparing Netflix and working from home conversations in Beauty, looking natural but still polished was highly important to those talking about working from home. Skincare concerns such as healthy skin, anti-aging, routine and the effects of blue light were also all more important to working from home. No makeup, on the other hand, in addition to self care Sunday skewed more towards Netflix conversations.

|

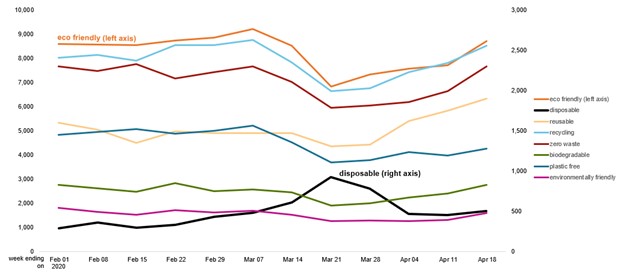

Rebound of Environmental Concerns

Eco-conscious topics are rebounding. During the weeks leading up to March 21st, we saw declining conversation around topics such as eco friendly, zero waste, recycling, and plastic free, in favor of increasing conversations mentioning disposable. Since then however, disposable conversations have declined and eco-conscious topics are becoming top of mind again.

| Trended conversation volume around eco-conscious topics |

|

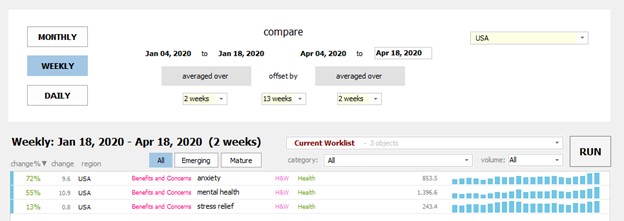

Anxiety, Mental Health and Stress Relief

Conversations around anxiety, mental health and stress relief in Beauty have increased both over the past 4 week and 13 week periods.

| Growth of anxiety, mental health and stress relief over the past 4 weeks |

|

| Growth of anxiety, mental health and stress relief over the past 13 weeks |

|

Self Care Continues to Rise

Interests around self care are at an all time high - its share of Beauty conversations have grown from 1.62% in March to 2.23% in April. Self care also experienced accelerated growth over the past 4 weeks compared to the past 13 weeks.

| Self care monthly activity |

|

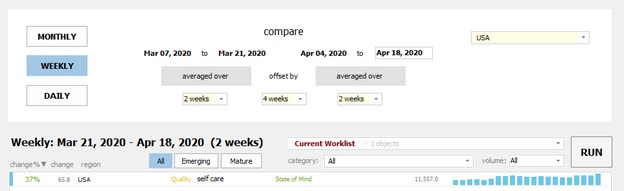

| Growth of self care over the past 4 weeks |

|

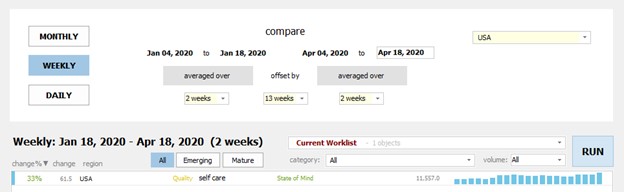

| Growth of self care over the past 13 weeks |

|

Products/services

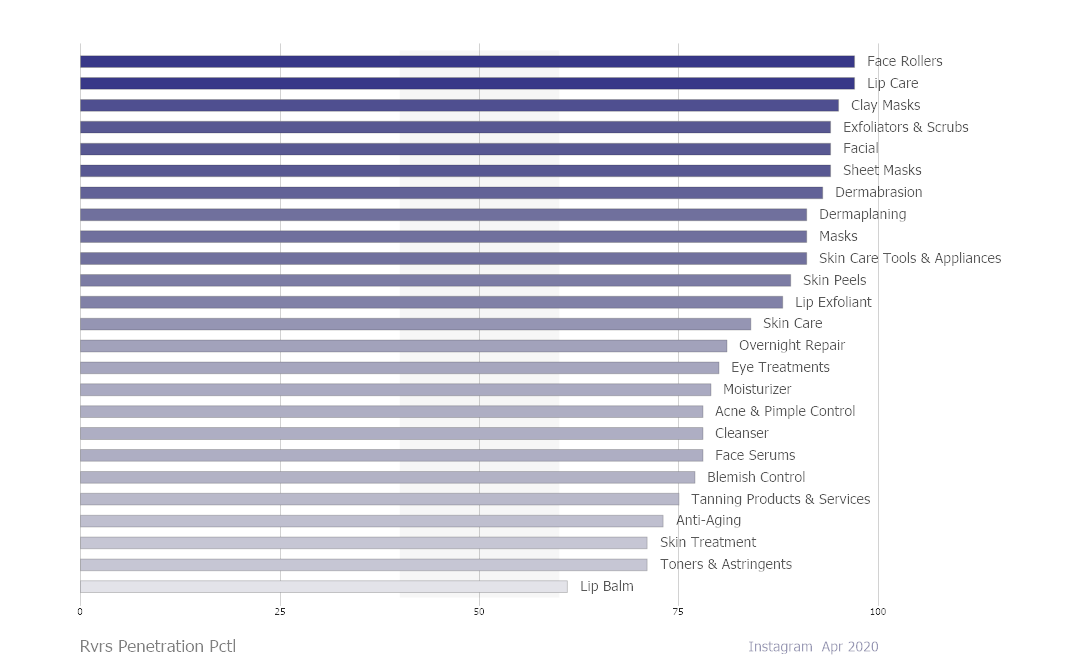

Charts below illustrate products and services that over-index in self care conversations, most of which are skin care related, and their growth/decline in self care conversations over the past month. Products are growing, while services are shrinking as a result of country-wide shut downs and closures of beauty salons.

| Significant products to self care conversations |

|

Consumers are turning back to the basics of skincare. Cleansers, moisturisers, toners & astringents and serums have all grown in self care over the past month, while products targeting specific concerns such as blemish control and acne & pimple control have slightly decreased in shares. Most growth seems to be around lip care products, especially in lip exfoliants and overnight repair.

| Growth/decline of significant products in self care |

|

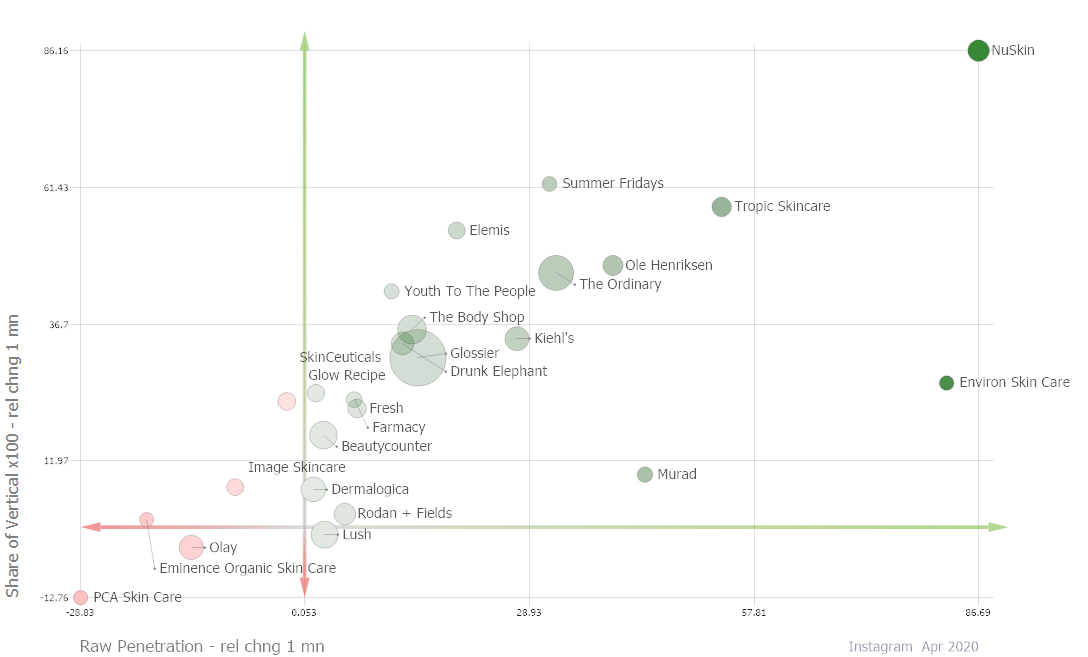

Brands

All of the brands that are most over-indexed in self care conversations in April are skincare-focused brands. The majority of those brands that grew in self care have also grown in their shares of all Beauty conversations.

| Significant brands to self care conversations |

|

It is notable that the relationship between these two metrics are almost perfectly linear, suggesting that growth in self care equates to growth in Beauty overall.

| Growth/decline of brands in self care vs. in Beauty |

|

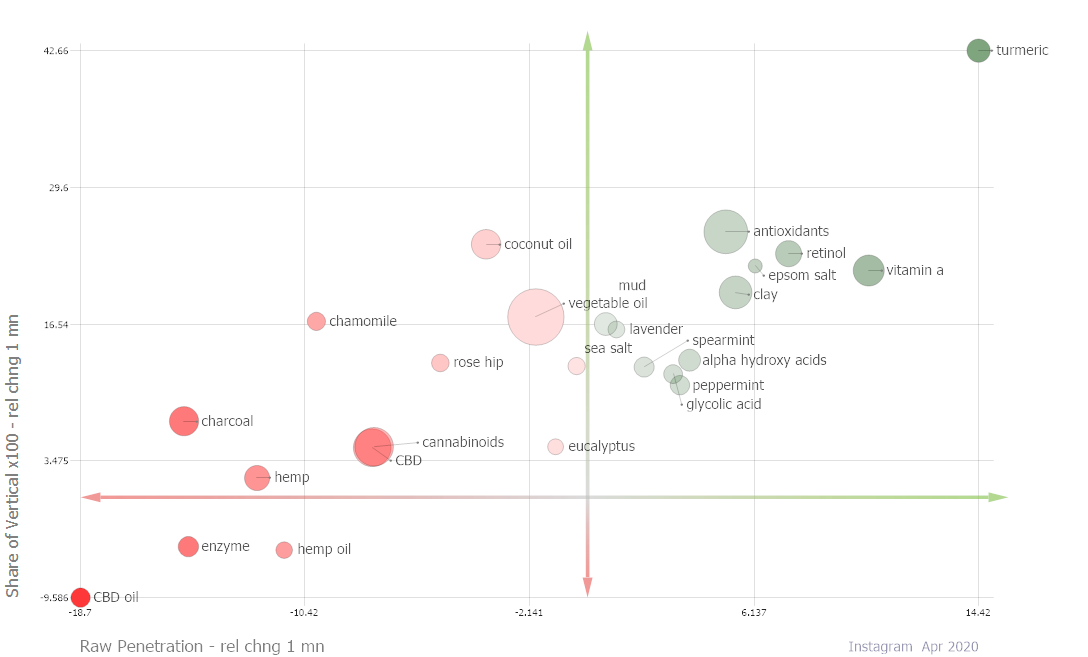

Ingredients

Below are ingredients that are significantly talked about in self care conversations, and their growth in self care and in Beauty over the past month. There seems to be a split between these ingredients: cannabis-related and some natural igredients are down, whereas vitamin a, retinol, acids and antioxidants are up.

| Significant ingredients to self care conversations |

|

| Growth/decline of ingredients in self care vs. in Beauty |

|

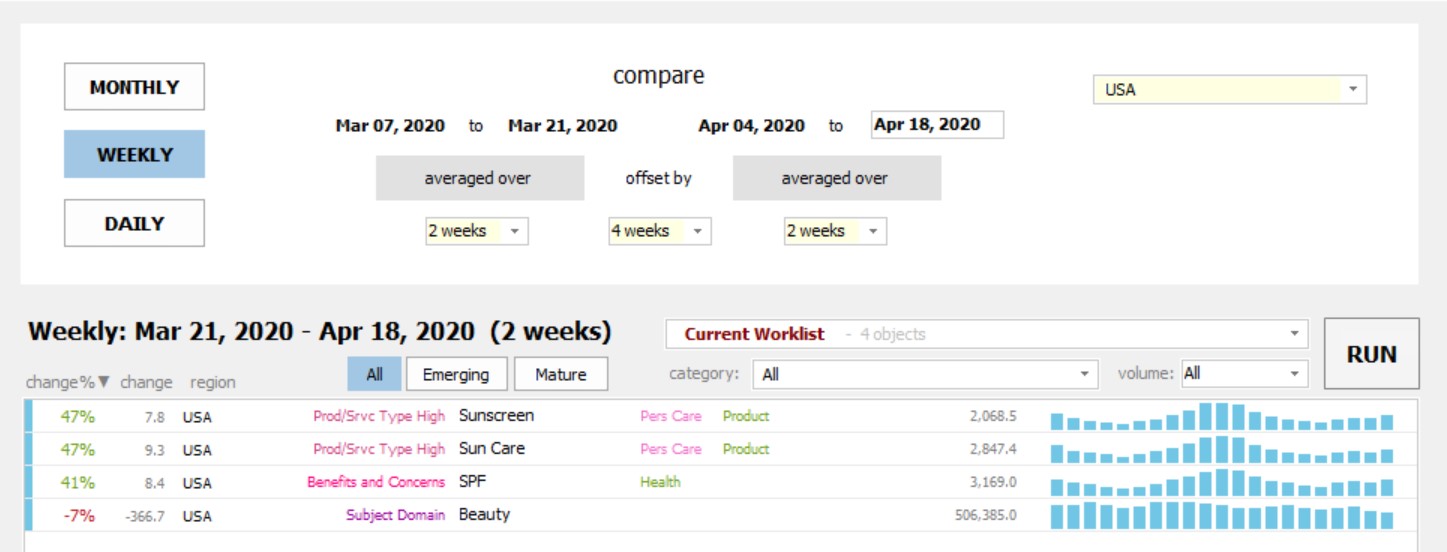

SPF

SPF conversations have grown in volume over the past 4 weeks. This is partly because it is getting hotter, and conversations around SPF are seasonal.

| Growth of SPF and related products over the past 4 weeks |

|

However, even when compared to this time last year, SPF conversations have risen significantly. Despite having to stay in, consumer interest in SPF is increasing.

| Growth of SPF and related products YoY |

|

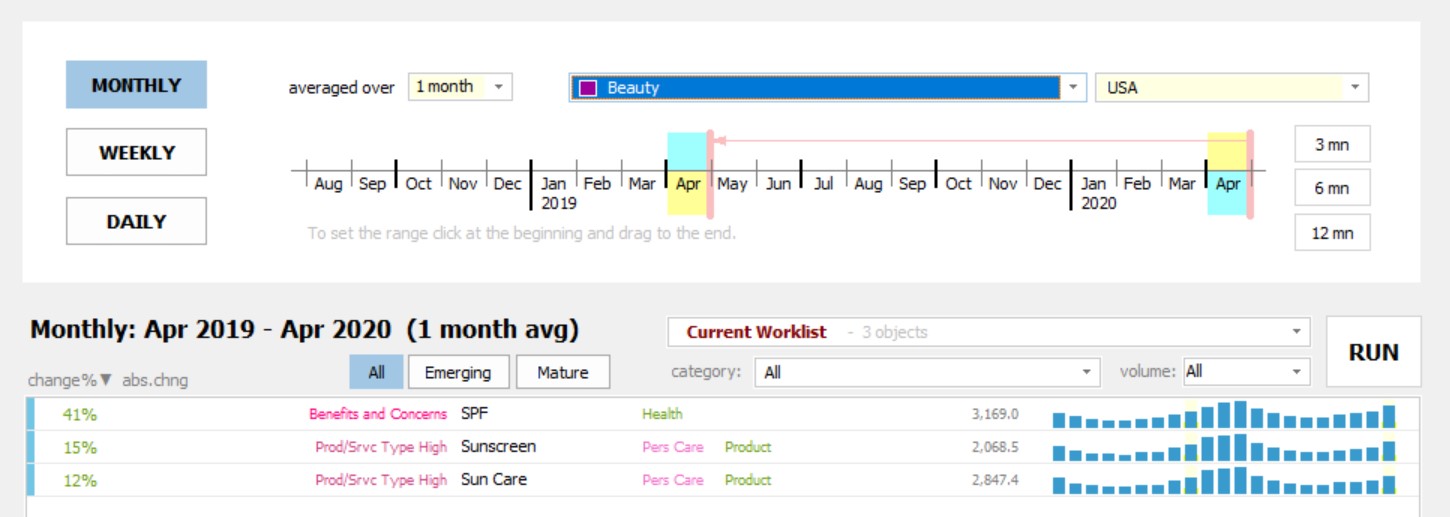

The graphic below shows the most over-indexed benefits & concerns in SPF conversations, with growth over the past year plotted on the x-axis and growth over the past month represented on the y-axis. Generally, SPF is increasingly associated with overall skin health and anti-aging concerns.

| Growth/decline of benefits & concerns significant to SPF conversations (YoY vs. MoM) |

|

Blue light is leading growth in the category, suggesting consumers are becoming more educated about the negative impacts to the skin that come, not just from being outside in the sun, but also from exposure to screens. Now that people are staying in, interests around SPF is not decreasing but rather shifting towards protecting your skin from various sources.Another noteworthy topic is SPF 15, which is typically the level of SPF included in face makeup products. With more education around SPF, consumers seem to be adding SPF to their regular makeup routines by using products with combined benefits instead of using a product with strong sun protection, especially given the current circumstances of continued quarantine and video conferencing.

Methodology

To provide our clients with the latest insights, our proprietary platform collects, analyzes, and benchmarks social data. Here’s what that process looks like:

|

for more on methodology Click Here if you have additional questions, please email Jordan Breslauer

2015-2021 © by Social Standards, Inc.

last updated on Sep 22, 2020

Object IDs successfully added to clipboard