Clean Beauty

Investigates the Clean Beauty category in an effort to better understand how consumers define Clean Beauty, with a particular focus on Instagram and TikTok.

Table of Contents:

Key Takeaways

Introduction

The Clean Beauty Consumer

Clean Beauty Defined

Cross Data Source Comparison

Clean Girl Aesthetic

Methodology & Appendix

Key Takeaways

Across Instagram and TikTok, Clean Beauty is becoming increasingly significant to the low income consumer while decreasing in significance to the high income consumer. Moreover, consumers considered luxury-focused based on the accounts they follow are slowly losing ownership of the category, which could mean Clean Beauty is becoming accessible to a wider array of consumers.

While skincare seems to dominate the Clean Beauty category across Instagram and TikTok, motives of the Clean Beauty consumer might differ across platforms. On Instagram, the Clean Beauty consumer seems mainly interested in the results they can extract from a Clean Beauty product, using terms like "glowing skin" and "hydrating" in Clean Beauty conversations. On TikTok, the category seems to be more all-encompassing, with clean living, as well as beauty and hair care routines, being significant to Clean Beauty.

The definition of a Clean Beauty product is similar across Instagram and TikTok. However, qualities like quenching, dermatologist tested, and healthy scalp are seeing growth in the category, which could indicate a shift in what Clean Beauty means to the consumer. Efficacy appears to be of increasing concern to Clean Beauty consumers, who are challenging brands to not only create a product free of harmful ingredients, but one that also generates results.

Introduction

Clean Beauty has permeated the Beauty industry for decades, but its exact meaning seems to be dependent on ever-changing attitudes defined by the time and the consumer. Is the 'clean' in Clean Beauty largely motivated by environmentally-conscious production? Are consumers more interested in a harmless ingredient list? Is Clean Beauty a luxury item exclusively available to the high income consumer? Does the label of Clean Beauty outweigh the efficacy of a product? This report tackles these questions and more using the power of Social Standards data across both Instagram and TikTok, for a more well-rounded view of the consumer.

The Clean Beauty Consumer

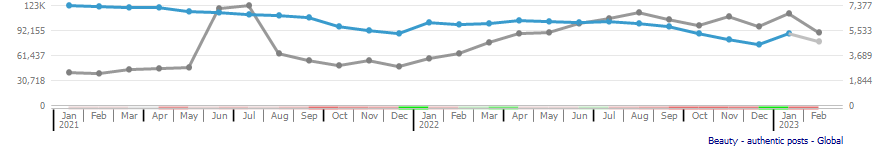

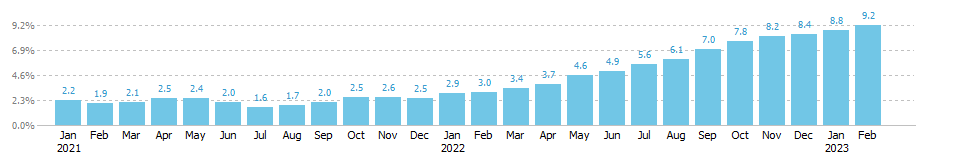

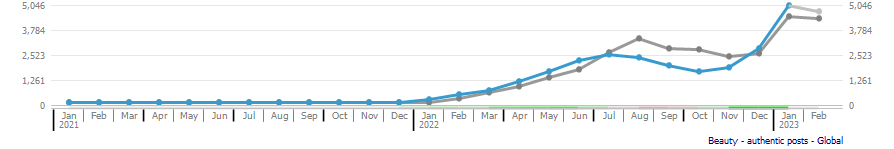

Clean Beauty post volume on Instagram has been steadily declining over time. Instagram post volume slightly jumps in January of each year, but is declining overall.

Conversely, despite Clean Beauty being a smaller topic on TikTok, post volume on the platform is taking off; the topic has roughly doubled in volume YoY.

| Monthly Post Volume of 'Clean Beauty' on Instagram (blue - left Y-axis) vs. TikTok (gray - right Y-axis) |

|

Demographics

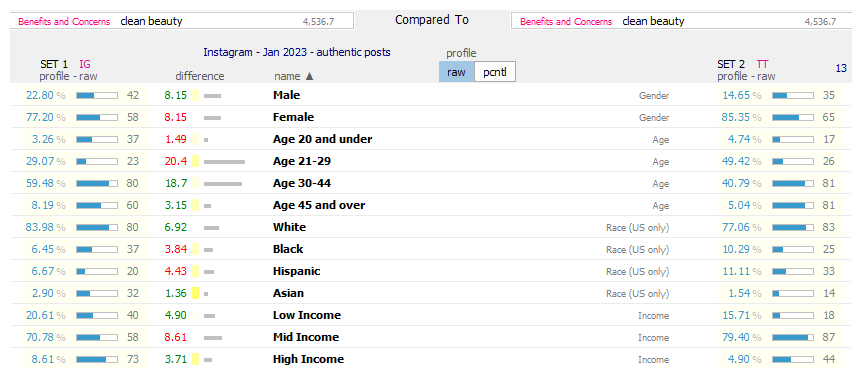

Demographic profiles for the Clean Beauty conversationalist on Instagram vs TikTok are relatively aligned. Clean Beauty is uniformly Female, Age 30+, and White skewing. A key differentiator between the two platforms' Clean Beauty consumers is that the Instagram Clean Beauty conversation skews Higher Income, while the TikTok conversation over-indexes for a Mid Income audience.

| 'Clean Beauty' (Instagram - left) vs 'Clean Beauty' (TikTok - right) Demographics Comparison |

|

Interpreting the visual: The chart above compares demographics and their skew towards Clean Beauty on IG vs clean beauty on TT. The 'difference' column subtracts the cohort's share of the conversation on IG vs TT. A difference score in green skews more towards Clean Beauty on IG and a difference score in red skews more towards Clean Beauty on TT.

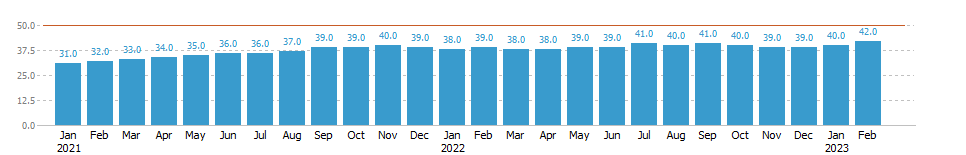

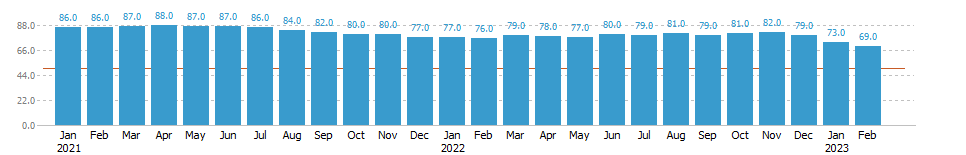

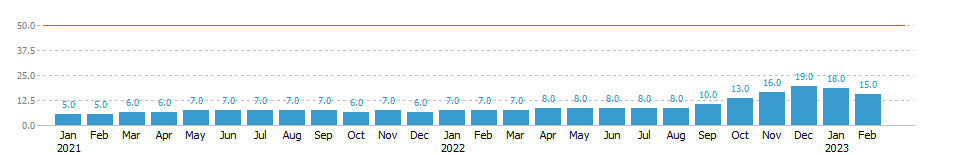

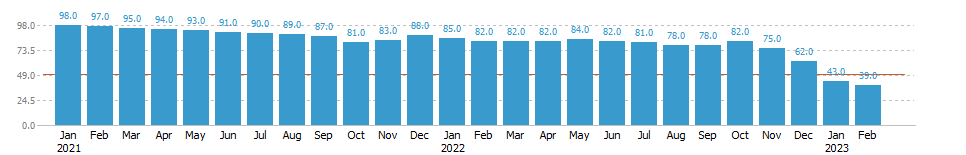

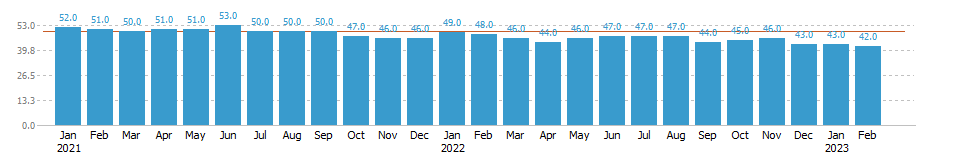

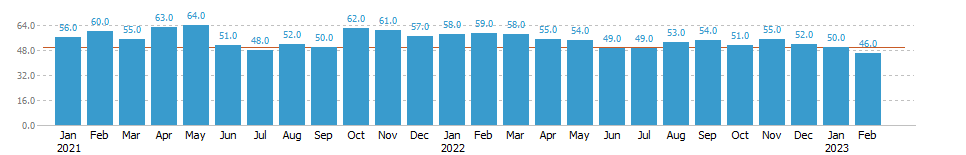

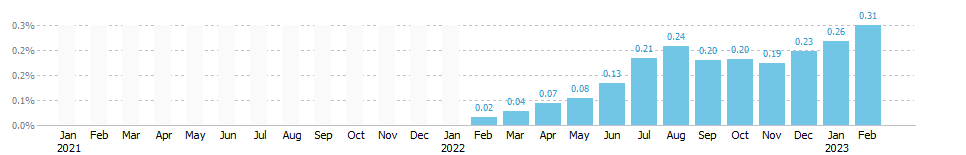

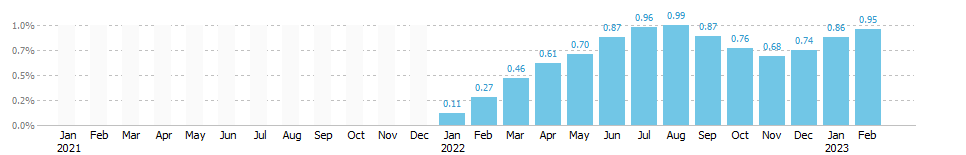

Clean Beauty is gaining traction with a lower income audience across both Instagram and TikTok; significance of high income contribution to the Clean Beauty conversation is dwindling over time on both platforms, while at the same time significance of low income contribution is increasing.

| Trended Significance of 'Low Income' Consumers to 'Clean Beauty' Posts - Instagram |

|

Interpreting the graph: The image above showcases the degree of importance of low income consumers to Clean Beauty relative to similarly categorized objects in Beauty

| Trended Significance of 'High Income' Consumers to 'Clean Beauty' Posts - Instagram |

|

| Trended Significance of 'Low Income' Consumers to 'Clean Beauty' Posts - TikTok |

|

| Trended Significance of 'High Income' Consumers to 'Clean Beauty' Posts - TikTok |

|

Interests & Affinities

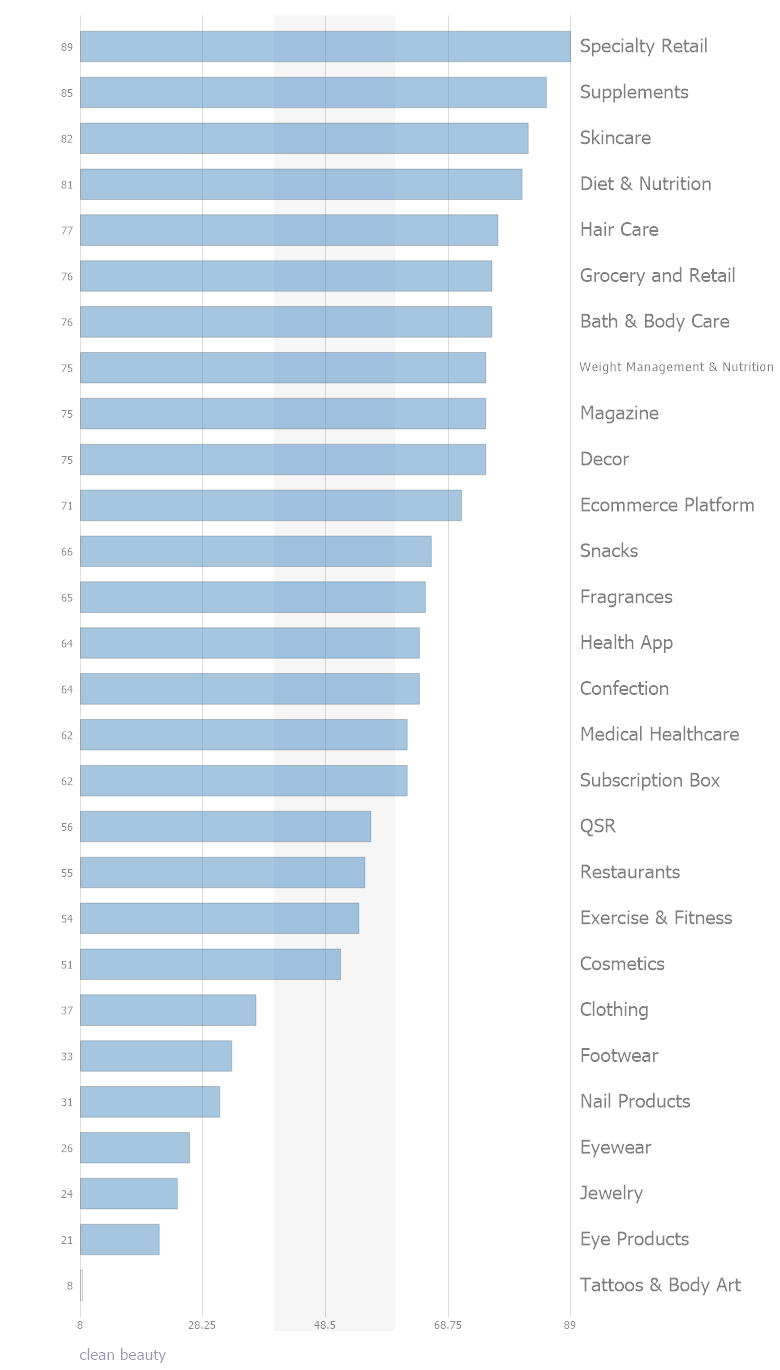

Consumer Interests are identified by the accounts that Instagram users follow. Compared to Affinities, Interests are more conscious behaviors that consumers might prioritize when purchasing goods.

Specifically, the Clean Beauty consumer on Instagram has identified interests in specialty retail, supplements, and skincare.

| Interests of the 'Clean Beauty' Consumer - Instagram |

|

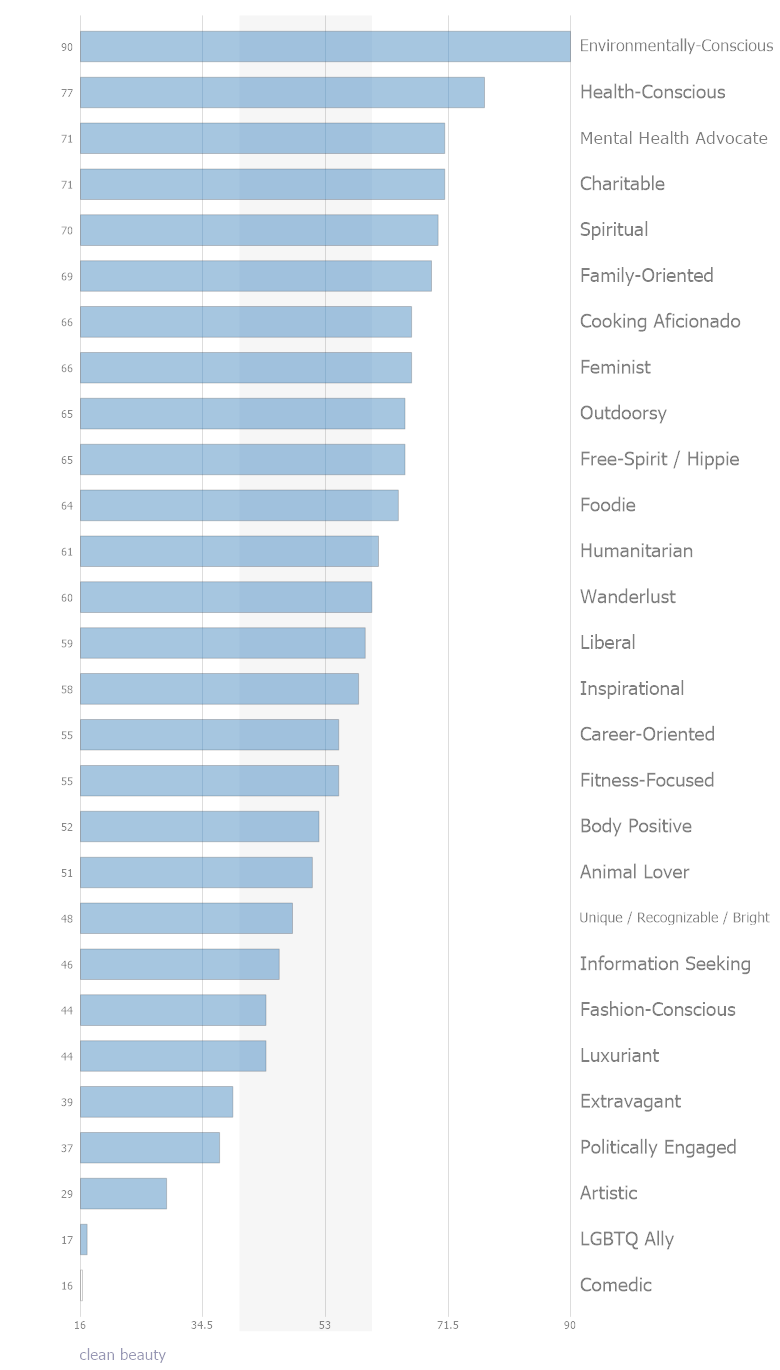

Consumer Affinities, also identified by what accounts users follow on Instagram, are more unconscious behaviors and provide insight into what might motivate a consumer to gravitate towards certain products.

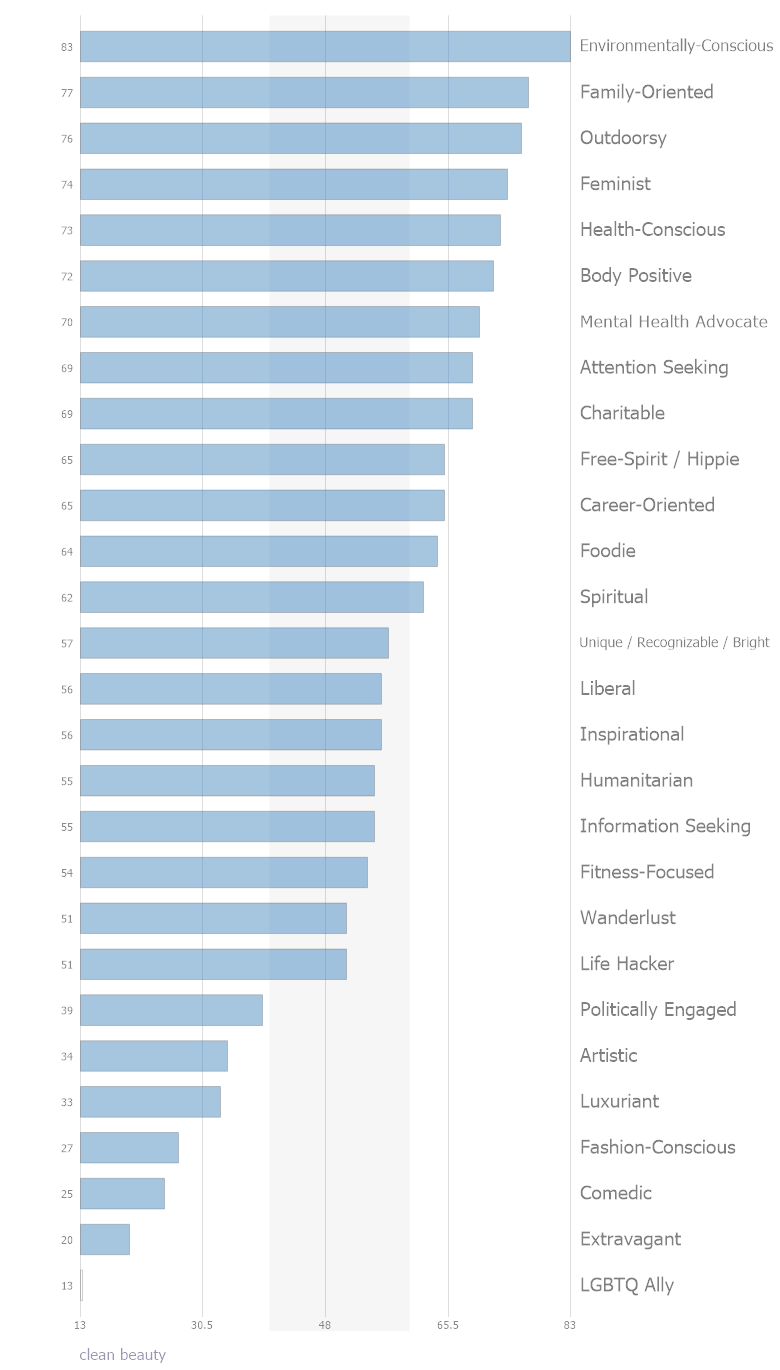

The Clean Beauty consumer could be described as both environmentally and health-conscious. This consumer seems to seek out accounts that emphasize the environment and consumer health. Conversely, this consumer does not appear to have an affinity for politics, comics, or the arts.

| Affinities of the 'Clean Beauty' Consumer - Instagram |

|

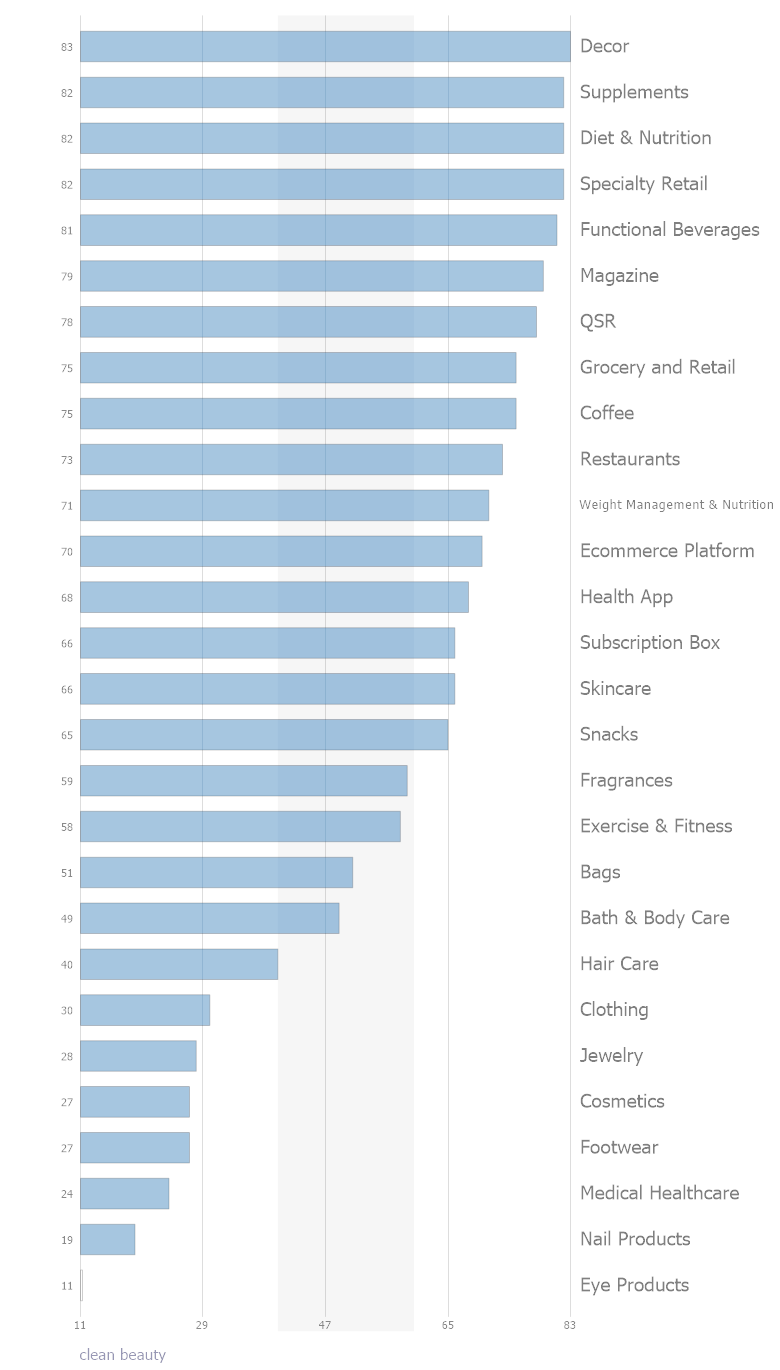

The Clean Beauty consumer on TikTok is interested in Decor, Supplements, and Diet & Nutrition. They are likely to follow environmentally-conscious, family-oriented, and outdoorsy accounts.

This consumer seems to have a more diverse array of interests outside of Beauty specifically, which could speak to the Clean Beauty poster engaging in a more holistic view of Clean Beauty ('clean living').

| Interests of the 'Clean Beauty' Consumer - TikTok |

|

| Affinities of the 'Clean Beauty' Consumer - TikTok |

|

The prevalence of Clean Beauty conversations stemming from a mid-income audience (re: Demographics Comparison visual, above) may be shifting general consumer attitudes away from high-cost associations with Clean Beauty products. This is apparent in the shifting income profile significance away from a high income consumer and towards a low income consumer, as well as the decreasing association between Clean Beauty and a 'Luxuriant'* consumer.

*Users were determined to have an affinity for 'Luxuriant' accounts based on their followership of accounts frequently mentioning luxury or connoting luxury. Accounts are determined to meet this criteria based on internal Social Standards evaluations.

| Significance of 'Luxuriant' Consumers to 'Clean Beauty' Posts - Instagram |

|

| Significance of 'Luxuriant' Consumers to 'Clean Beauty' Posts - TikTok |

|

Clean Beauty Defined

On Instagram, ...

Key Descriptors

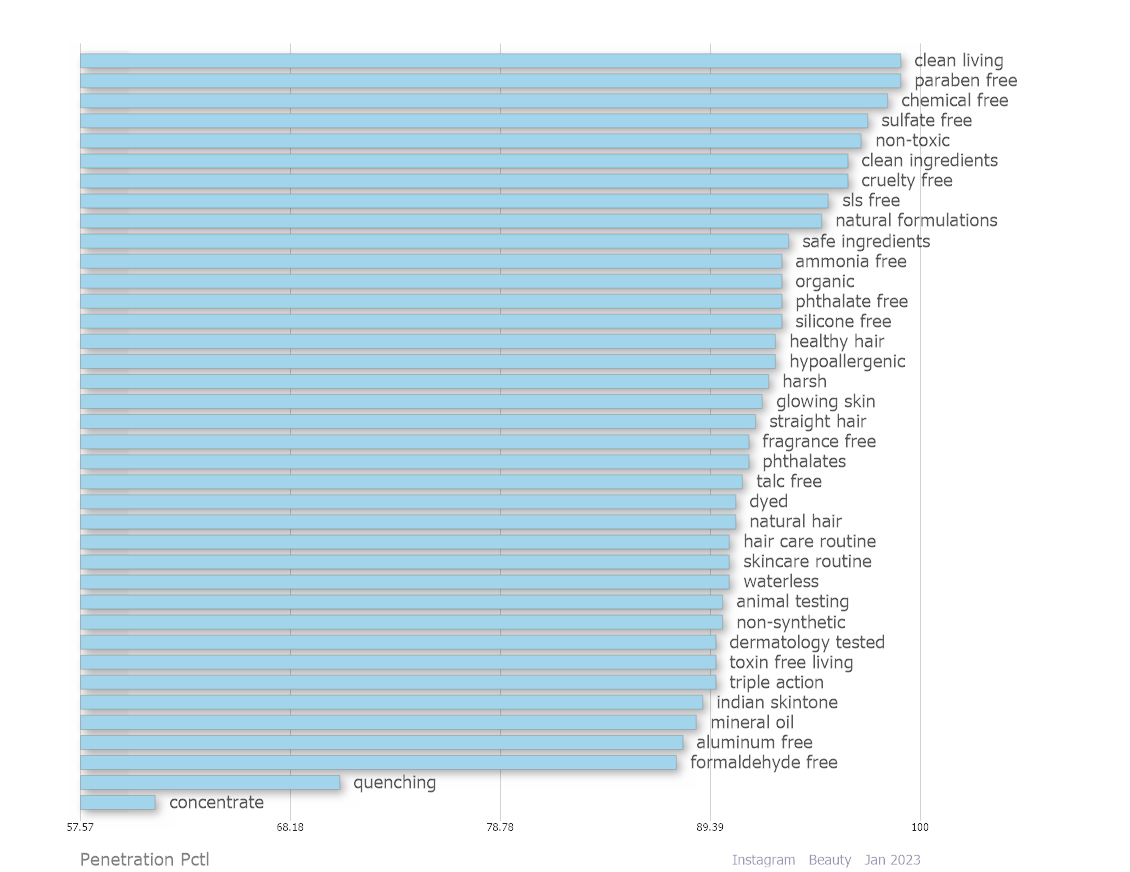

Clean living is the most significant descriptor to Clean Beauty posts. Many descriptors ending in 'free' show up alongside Clean Beauty on Instagram, signaling users likely recognize Clean Beauty to mean free from certain ingredients and practices.

| Key Descriptors Mentioned Alongside 'Clean Beauty' - Instagram |

|

| X-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in Clean Beauty conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

Users discussing Clean Beauty seem to be increasingly prioritizing results, specifically in regard to skincare.

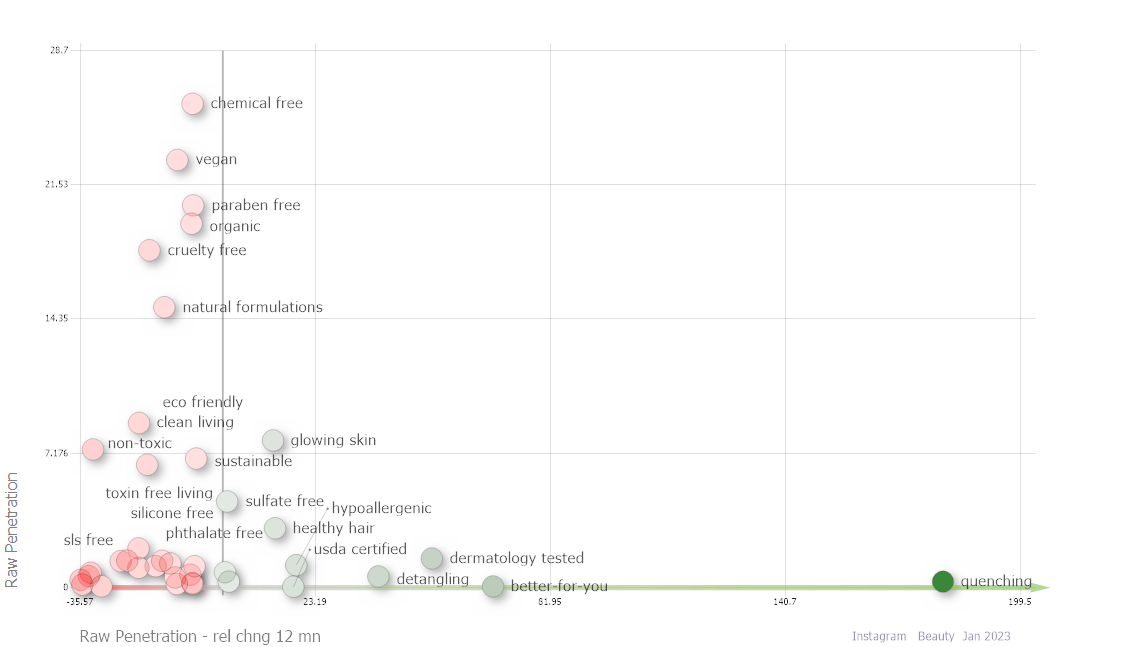

While consumers on this platform are over-indexed in discussing product formulations like chemical free and non-toxic (above), these topics appear to be losing category share. Meanwhile, topics like glowing skin and quenching are both being mentioned alongside Clean Beauty more so than expected, and increasing in share YoY.

Moreover, dermatology tested has seen an over 50% increase in share of the category on Instagram YoY, which may also indicate growing attention to product efficacy. Specifically, Instagram users seem to be discussing Clean Beauty predominately in a skincare context, and are keeping tabs on results.

| Share vs Growth of Key Descriptors Mentioned Alongside 'Clean Beauty' - Instagram |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? |

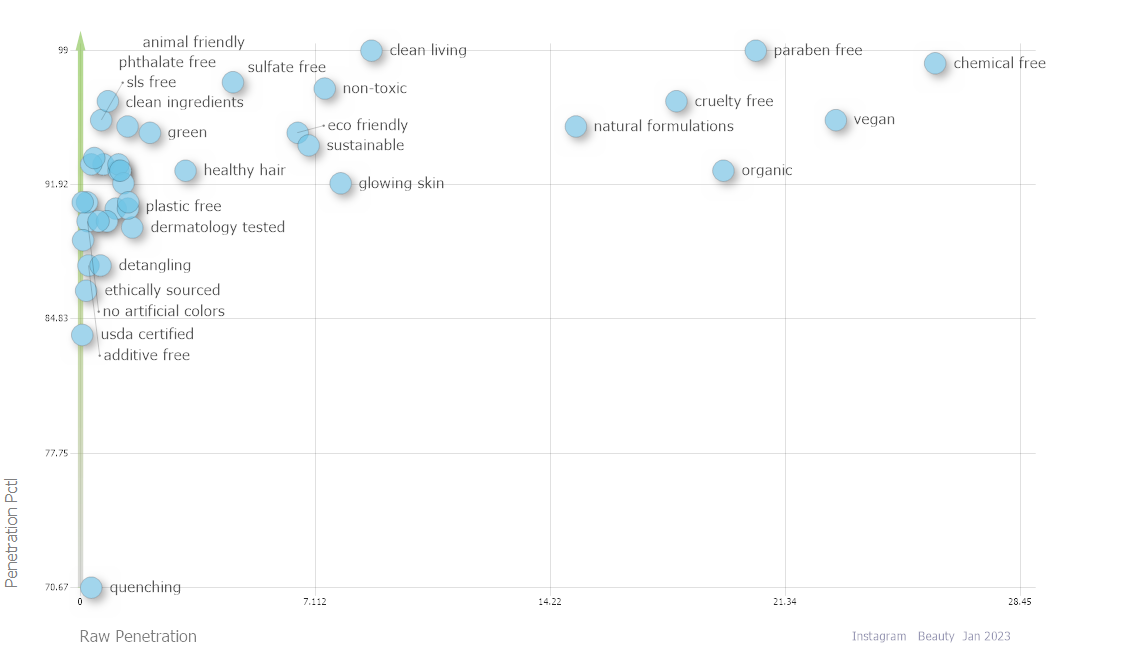

The visual below aims to show which industry-defining terms* are most prevelant and significant to the Clean Beauty Instagram conversation. Chemical free, vegan, paraben free, and organic appear most frequently in Clean Beauty posts on Instagram.

*'Industry-defining terms' refers to all objects in the Social Standards database internally deemed representative of the current industry standard for Clean Beauty.

| Clean Beauty Defining Qualities Mentioned Alongside 'Clean Beauty' - Instagram |

|

| X-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in Clean Beauty conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

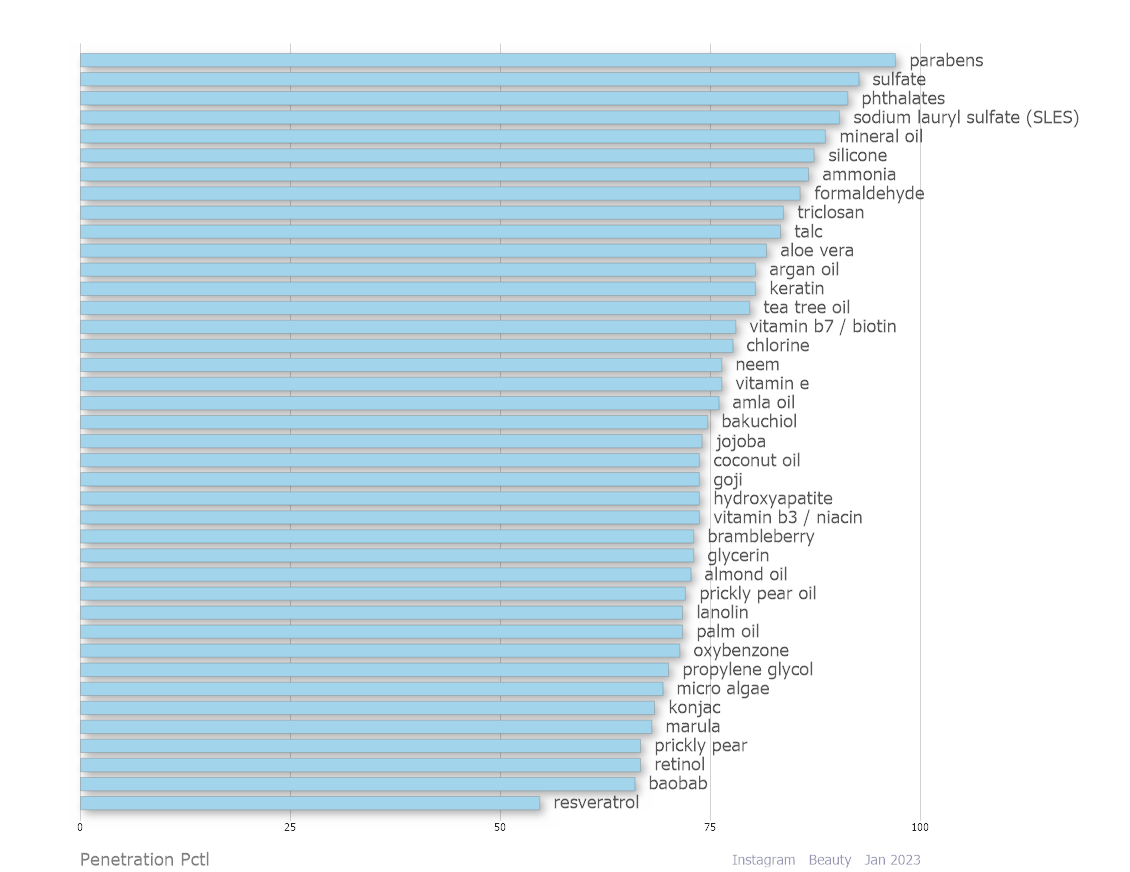

Ingredients

Ingredients significantly mentioned alongside Clean Beauty on Instagram include many that are associated with not being clean; users likely reference these ingredients alongside 'free', noting a clean product is free of potentially harmful additives, or as a statement that regards a product as not clean by calling out the inclusion of one of these ingredients.

| Ingredients Mentioned Alongside 'Clean Beauty' - Instagram |

|

| X-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in Clean Beauty conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

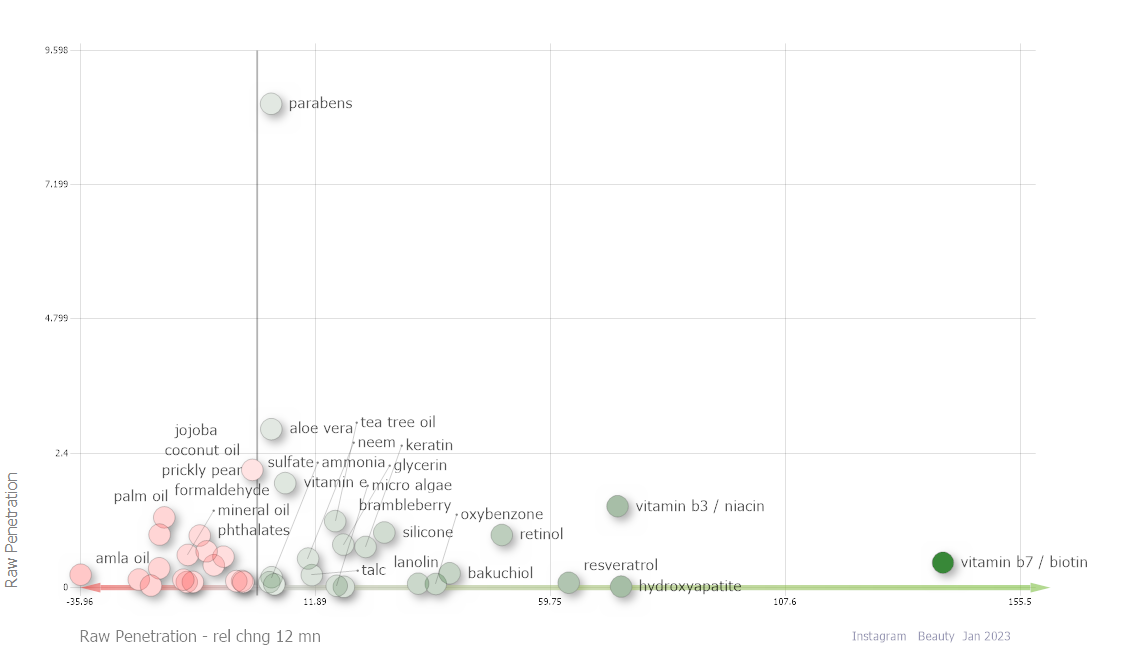

Vitamins are growing in mention frequency alongside of Clean Beauty, along with retinol and alternatives. Ingredients declining in association with Clean Beauty include many oils, such as jojoba, palm, and mineral oil.

| Share vs Growth of Ingredients Mentioned Alongside 'Clean Beauty' - Instagram |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? |

Ingredients growing both in visibility within Clean Beauty posts and in post volume overall include those highlighted below in yellow. Most ingredients depicted below appear to be declining on Instagram overall.

| Ingredients Significant to 'Clean Beauty' - Growth Alongside 'Clean Beauty' vs Growth on Instagram |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? |

Brands & Products

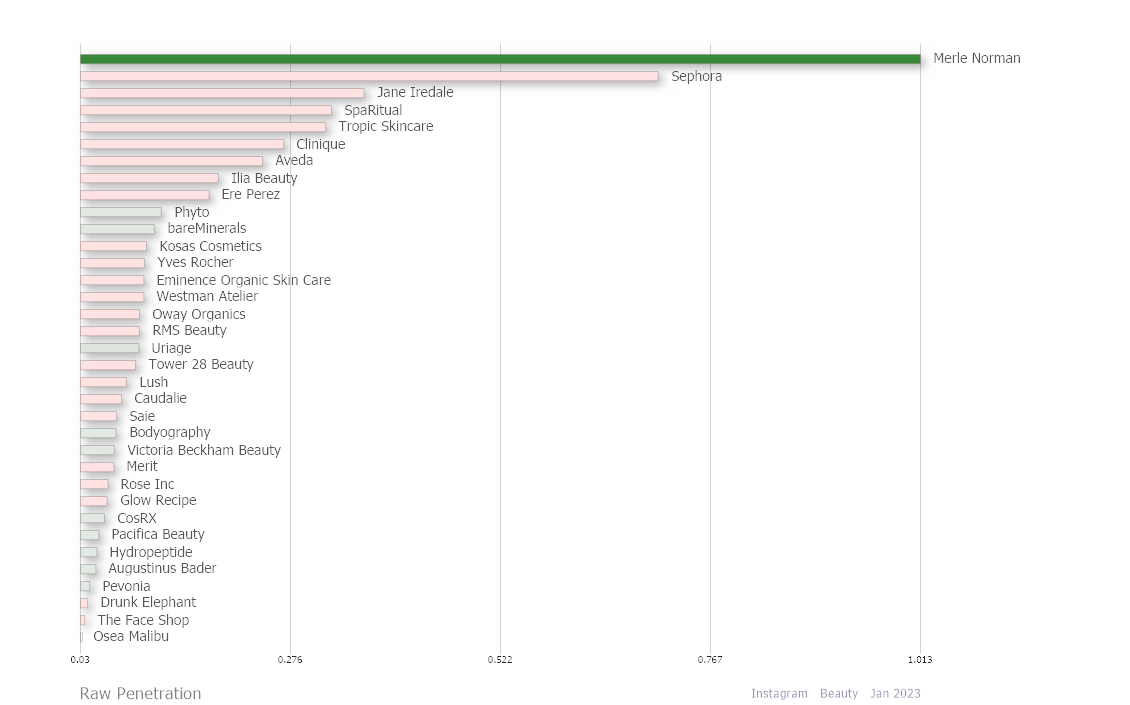

Merle Norman has the highest share of Clean Beauty conversations on Instagram, and the brand has seen extreme growth in the category YoY.

| Top Brands Mentioned Alongside of 'Clean Beauty' by Frequency - Instagram |

|

| X-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Shading Color: | Raw Penetration chng | Has the topic grown (green) or declined (red) in Clean Beauty conversations over the last 3 months (rel chng) - avg. over 3 months? |

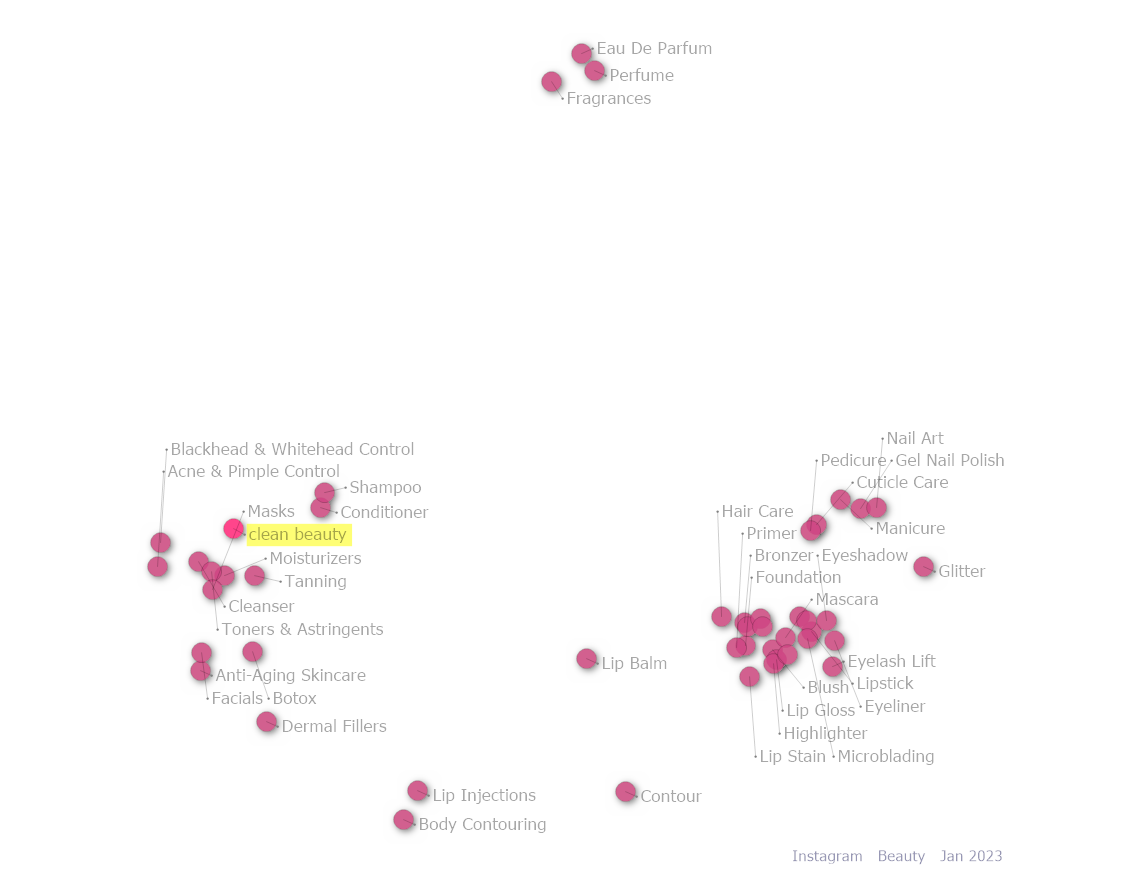

Clean Beauty was determined to be spoken about similarly to many skincare and personal care products. Conversations about Clean Beauty were deemed dissimilar to those of cosmetics products and fragrances. We can glean from this that Clean Beauty is discussed in the forum of skincare rather than fragrance or cosmetics.

| Product Type Correlation-based Clustering - Instagram |

|

Interpreting the visual: Our correlation metric tells you how similar (or dissimilar) conversations about two objects are to one another. Objects grouped closely (e.g. Shampoo and Conditioner) are spoken about similarly on Instagram, while objects far apart are spoken about dissimilarly. Correlation coefficients are calculated based on all respective index values for both subjects.

| Object Clustering: | Correlation | Objects are clustered by correlation to each other |

On TikTok, ...

Key Descriptors

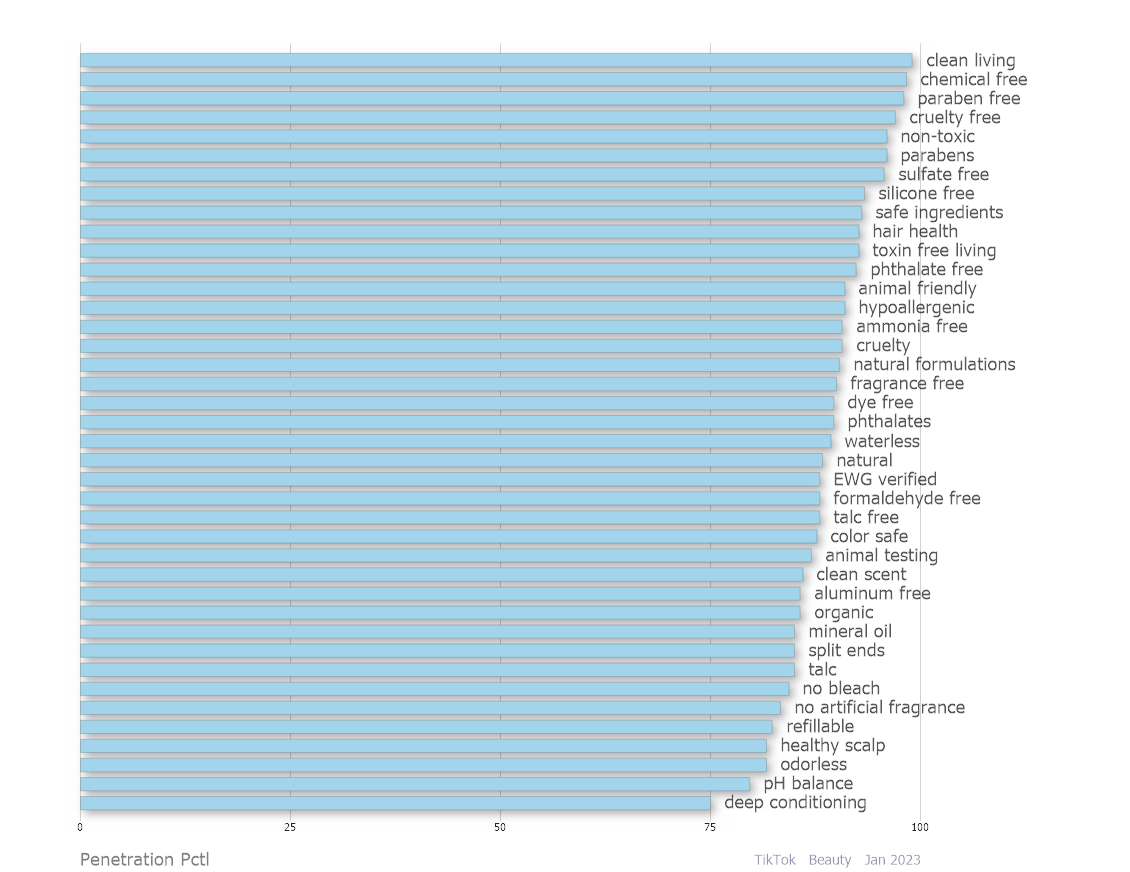

Similar to Instagram, clean living seems to be at the forefront of the Clean Beauty consumer's mind on TikTok.

| Key Descriptors Mentioned Alongside 'Clean Beauty' - TikTok |

|

| X-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in Clean Beauty conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

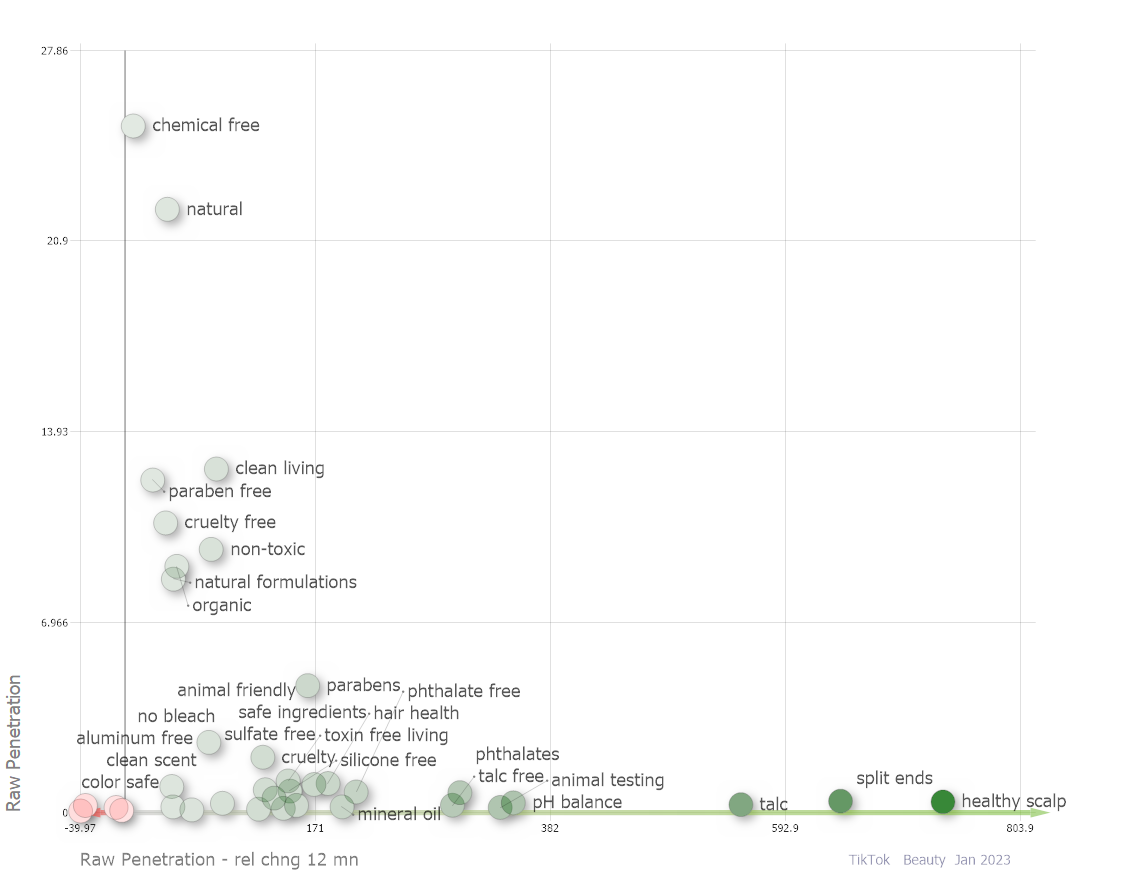

However, unlike Instagram, this holistic association of Clean Beauty with clean living is growing YoY. While formulation-related topics like safe ingredients and chemical free are gaining share of the category, Clean Beauty consumers on TikTok seem especially interested in hair care, with terms like healthy scalp and split ends seeing the fastest category gains YoY.

| Share vs Growth of Key Descriptors Mentioned Alongside 'Clean Beauty' - TikTok |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? |

Ingredients

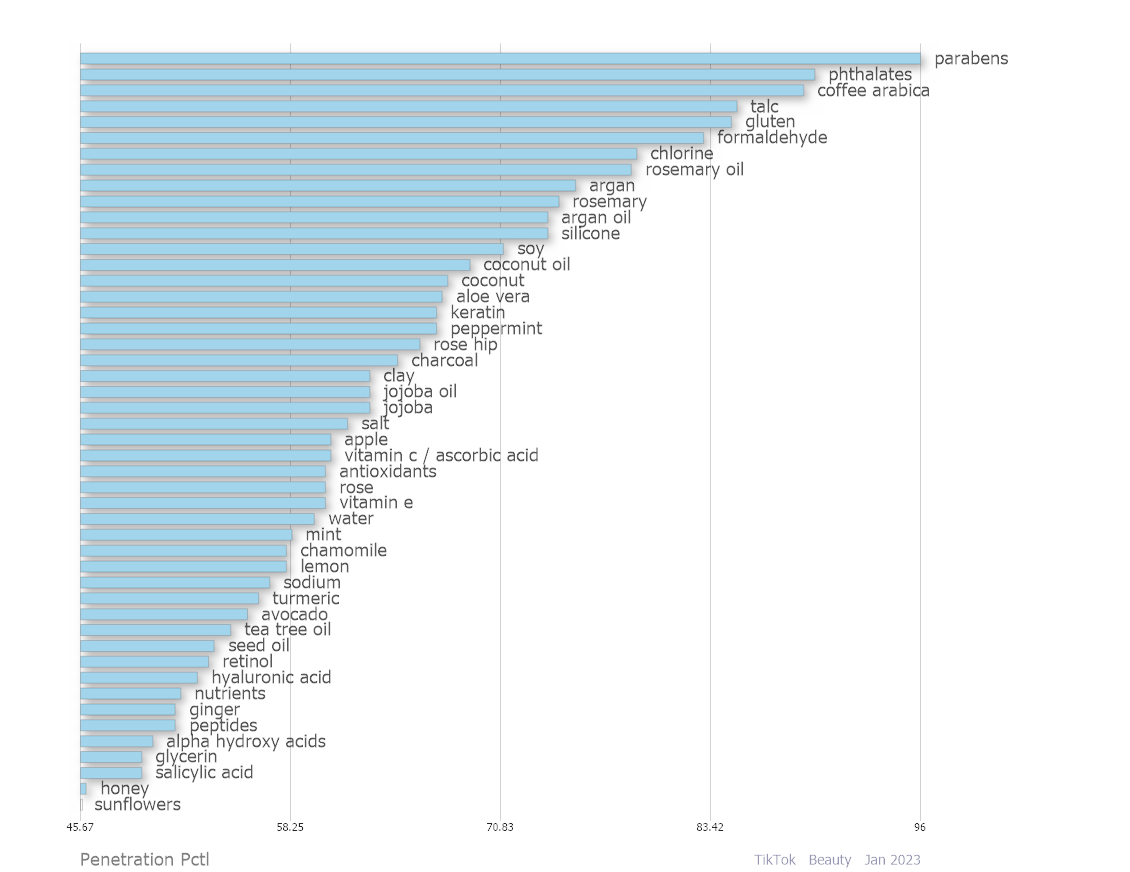

Similar ingredients show significance to the Clean Beauty conversation on TikTok as on Instagram, suggesting consumers may align in their definition of Clean Beauty across platforms.

| Ingredients Mentioned Alongside 'Clean Beauty' - TikTok |

|

| X-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in Clean Beauty conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

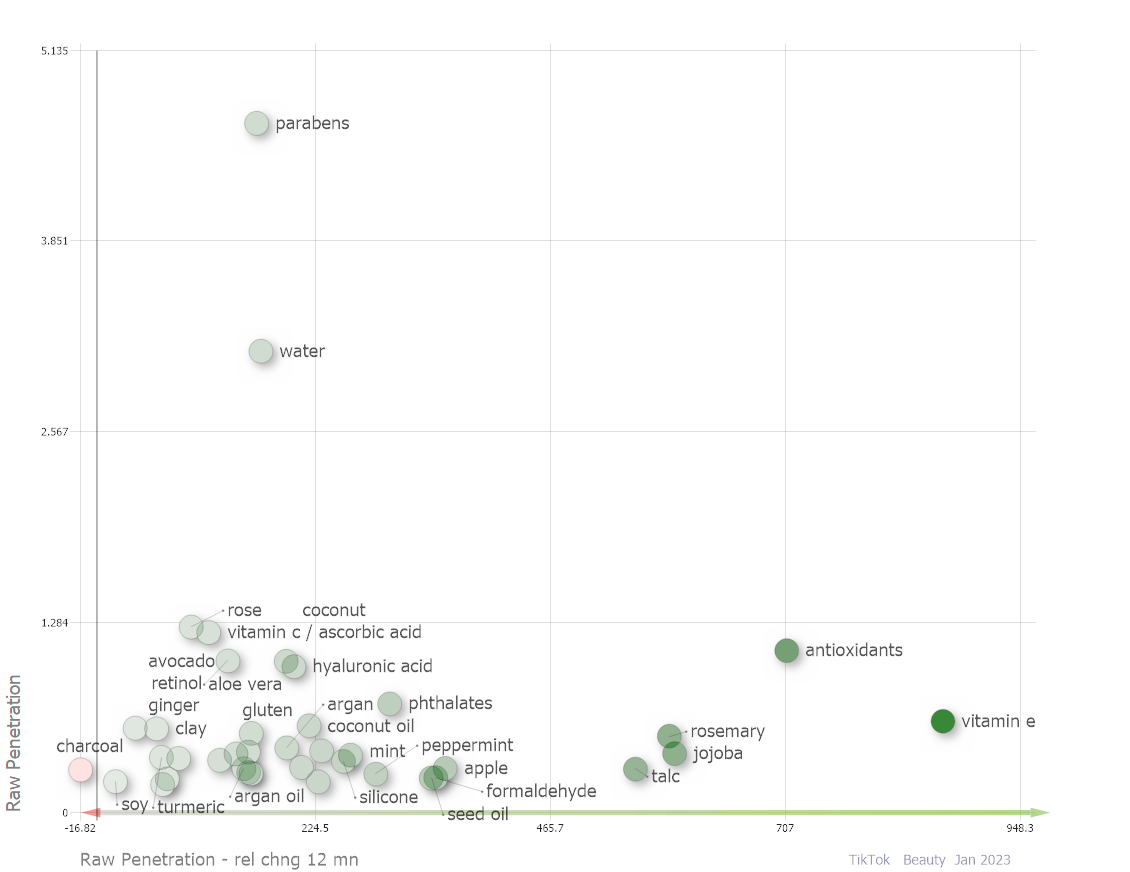

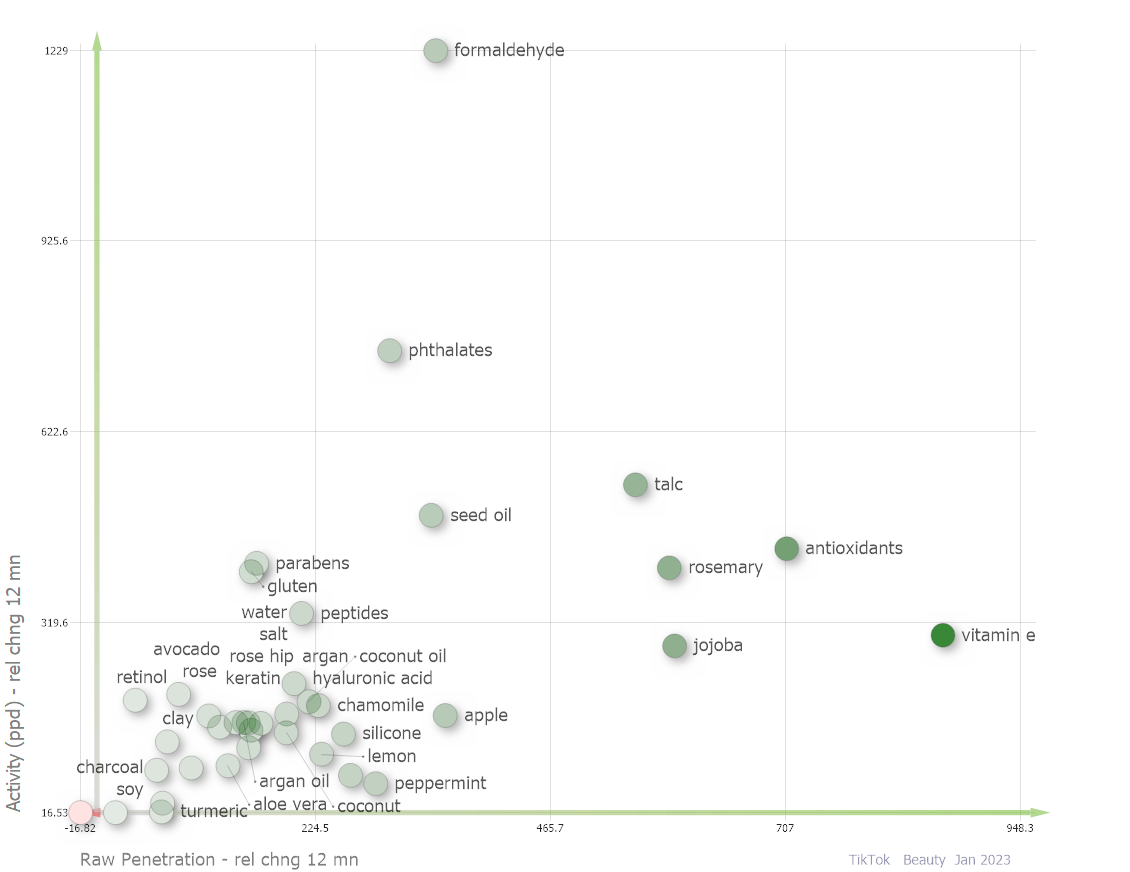

While vitamin b took center stage in terms of growth on Instagram, vitamin e leads ingredient growth in Clean Beauty posts on TikTok.

| Share vs Growth of Ingredients Mentioned Alongside 'Clean Beauty' - TikTok |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? |

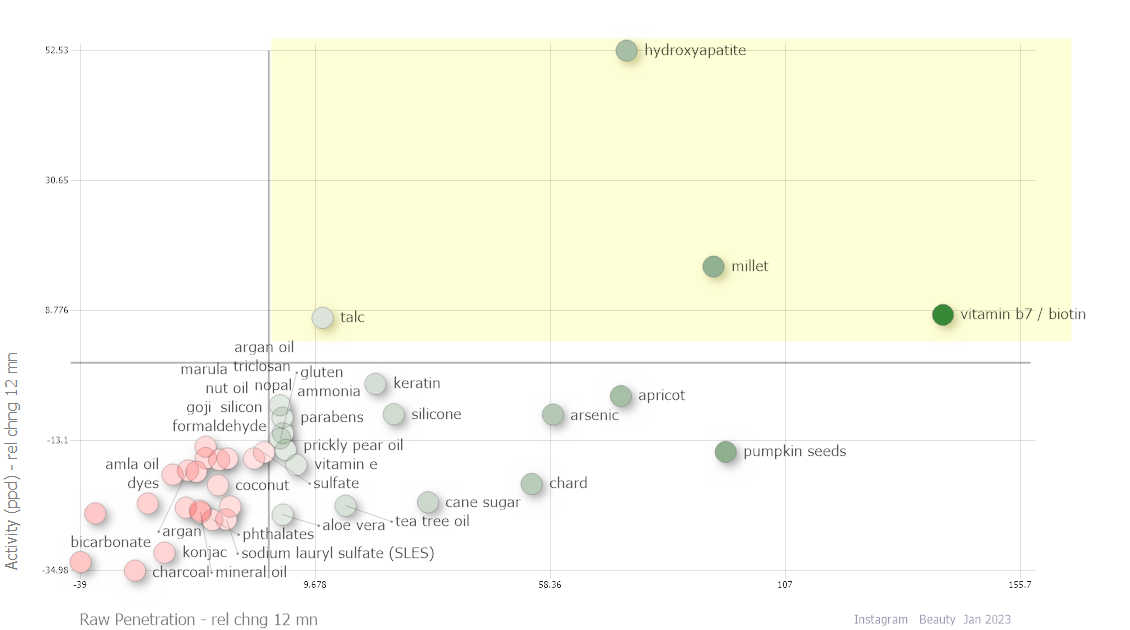

All ingredients growing in association with Clean Beauty are also growing on TikTok overall. Users may increasingly value Clean Beauty products as a vessel for their topical active ingredients.

| Ingredients Significant to 'Clean Beauty' - Growth Alongside 'Clean Beauty' vs Growth on TikTok |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in Clean Beauty conversations over the last 12 months (rel chng) - avg. over 3 months? |

Brands & Products

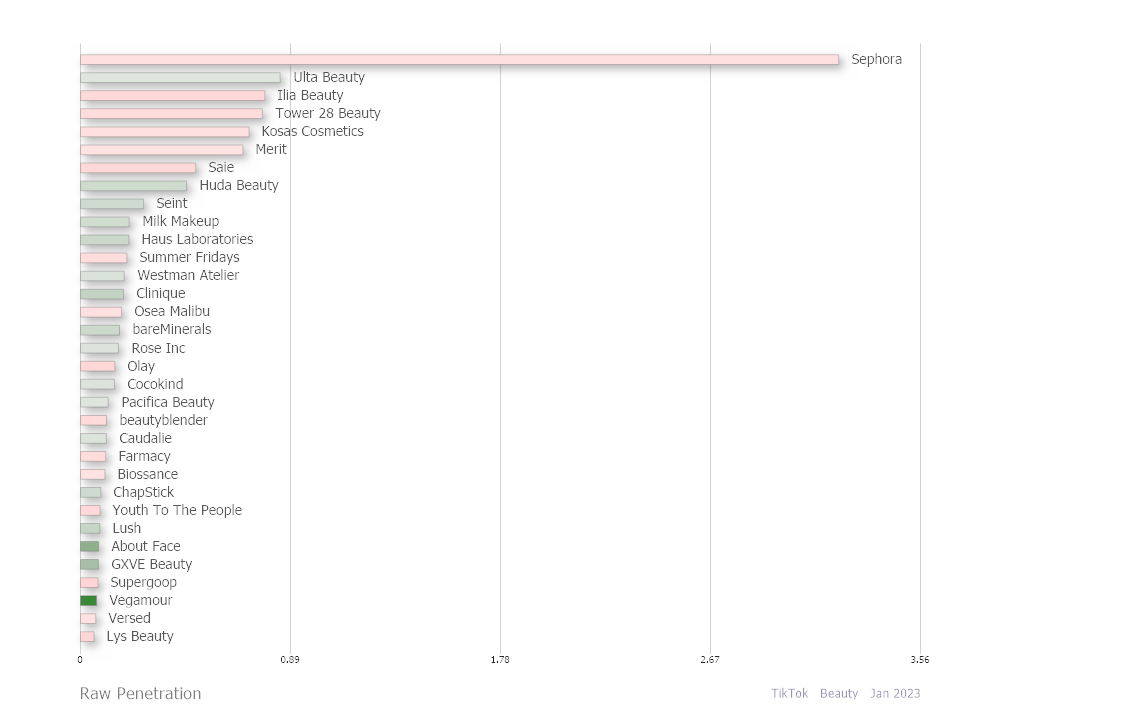

Sephora and Ulta Beauty have the highest share of Clean Beauty conversations on TikTok. This could suggest that consumers on TikTok are more likely to discuss where they found Clean Beauty products rather than the brands offering said products. Vegamour has seen the largest growth in share of the category YoY at roughly 270%.

| Top Brands Mentioned Alongside of 'Clean Beauty' by Frequency - TikTok |

|

| X-axis: | Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | ||||

| Shading Color: | Raw Penetration chng | Has the topic grown (green) or declined (red) in Clean Beauty conversations over the last 3 months (rel chng) - avg. over 3 months? |

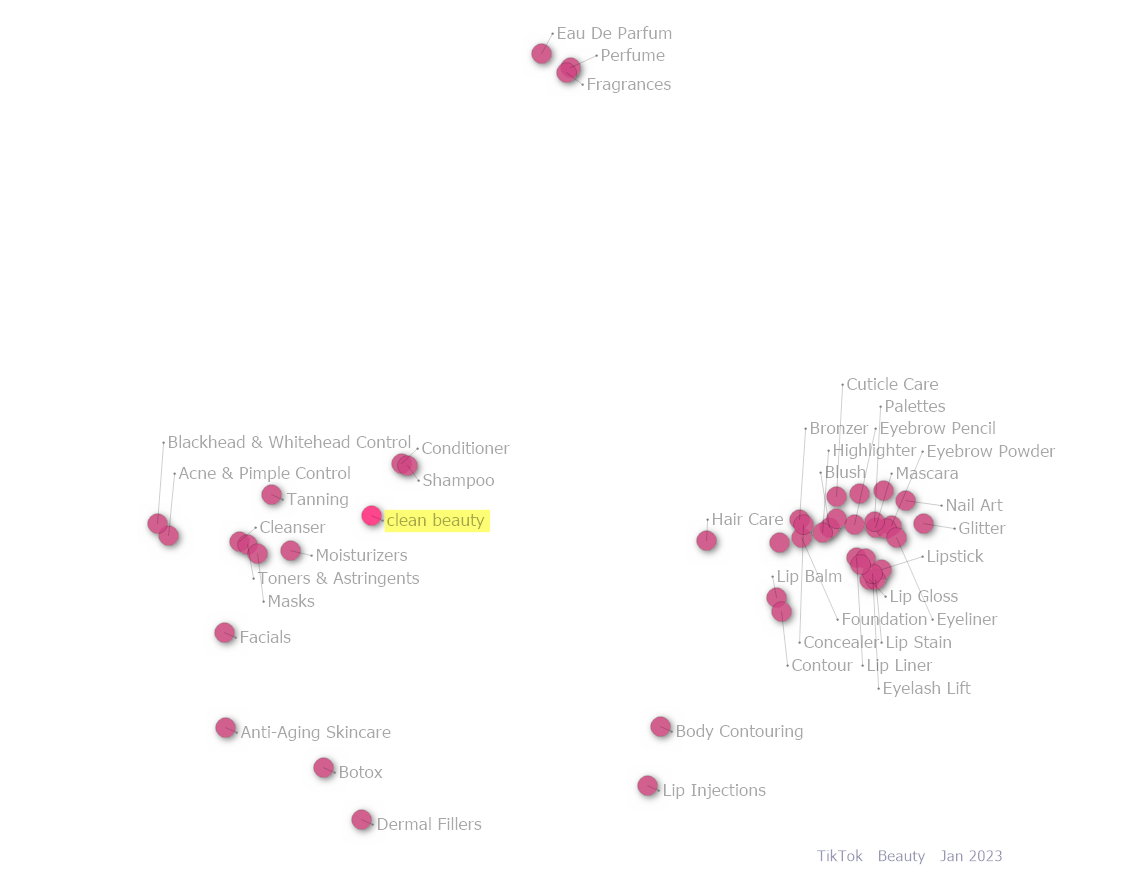

The product type correlation cluster graph for TikTok conversations looks very similar to that of Instagram.

Clean Beauty was determined to be spoken about similarly to many skincare and personal care products. Conversations about Clean Beauty were deemed dissimilar to those of cosmetics products and fragrances. We can glean from this that Clean Beauty is discussed in the forum of skincare on TikTok, but is not as strongly associated with skincare products as it is on Instagram given the looser clustering in this visual compared to its Instagram counterpart (re: prior section).

| Product Type Correlation-based Clustering - TikTok |

|

| Object Clustering: | Correlation | Objects are clustered by correlation to each other |

Interpreting the visual: Our correlation metric tells you how similar (or dissimilar) conversations about two objects are to one another. Objects grouped closely (e.g. Shampoo and Conditioner) are spoken about similarly on Instagram, while objects far apart are spoken about dissimilarly. Correlation coefficients are calculated based on all respective index values for both subjects.

Efficacy

While skincare results might be a new priority in Clean Beauty conversations on Instagram, consumers have always been interested in Clean Beauty product efficacy on the platform. However, efficacy is quickly gaining share of the category on TikTok, where users may be increasingly scrutinous of Clean Beauty products providing advertised results.

| 'Efficacy' Share of 'Clean Beauty' Posts - Instagram |

|

| 'Efficacy' Share of 'Clean Beauty' Posts - TikTok |

|

Pricing Associations

Note: Terms that define and count as a mention of Pricing - Positive include value, reasonable price, worth the hype, and more. Terms that define and count as a mention of Pricing - Negative include costly, inflation, expensive, and more.

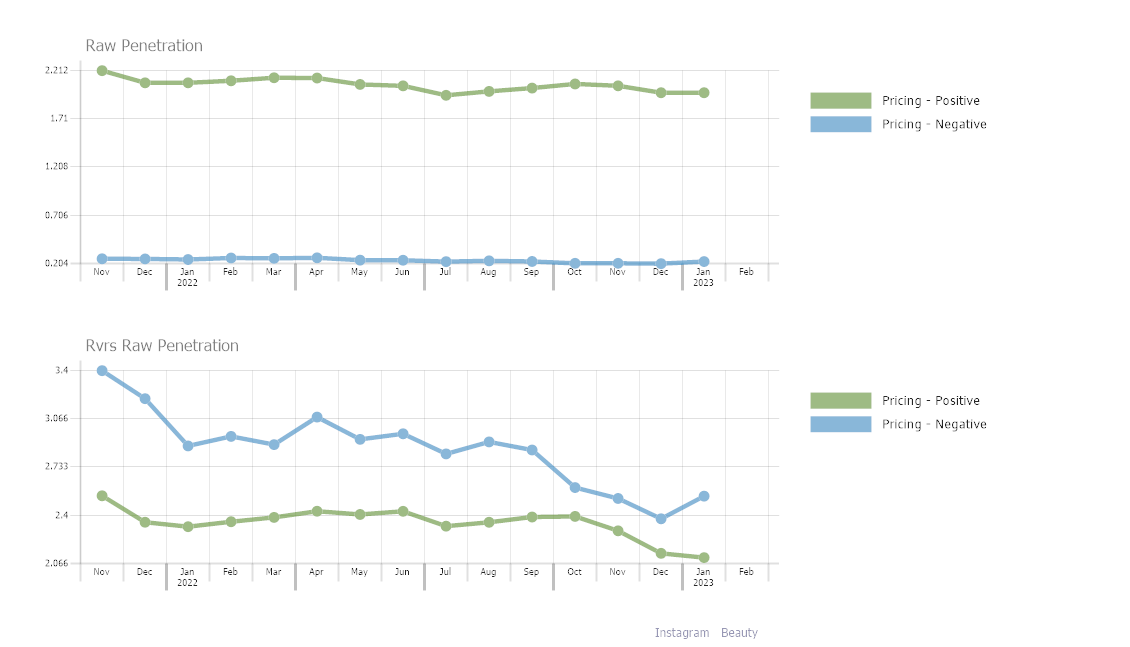

On Instagram, Pricing - Positive has consistently had a higher share of Clean Beauty conversations. This could be a result of the Clean Beauty consumer on the platform being of a higher income who may be willing to spend more on a product without complaint. However, as of late, when consumers mention negative pricing terms, they are less likely to mention Clean Beauty. This might suggest that while the average Clean Beauty consumer on Instagram has always found the category to be affordable, the average Beauty consumer is decreasingly associating this category with negative pricing terms.

| Trended Pricing Associations for 'Clean Beauty' - Instagram |

|

| Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | |||||

| Rvrs Raw Penetration % | How frequently was Clean Beauty mentioned in the topic conversations - avg. over 3 months? |

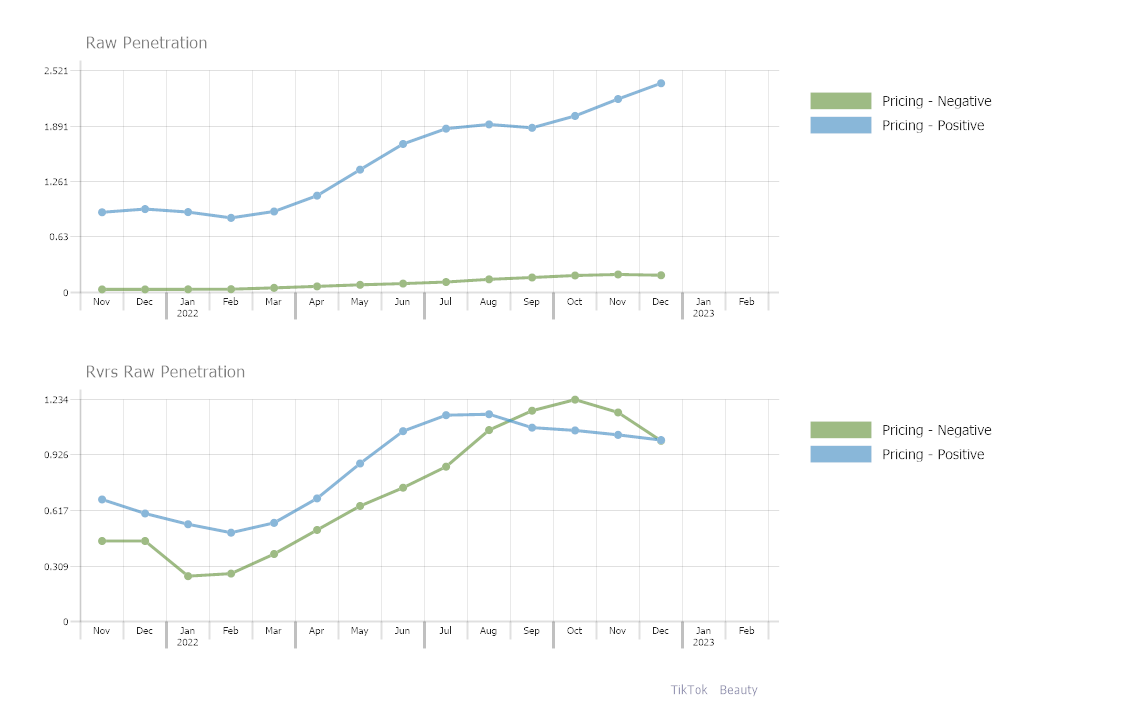

Given the larger bump in the low income cohort's association with Clean Beauty on TikTok, it makes sense that consumers on the platform are increasingly discussing Clean Beauty alongside terms like affordable and discount. While some TikTok consumers might still be likely to think of Clean Beauty when they discuss Pricing - Negative, those talking about Clean Beauty outright on the platform are finding the category more affordable than ever.

| Trended Pricing Associations for 'Clean Beauty' - TikTok |

|

| Raw Penetration % | How frequently was the topic mentioned in Clean Beauty conversations - avg. over 3 months? | |||||

| Rvrs Raw Penetration % | How frequently was Clean Beauty mentioned in the topic conversations - avg. over 3 months? |

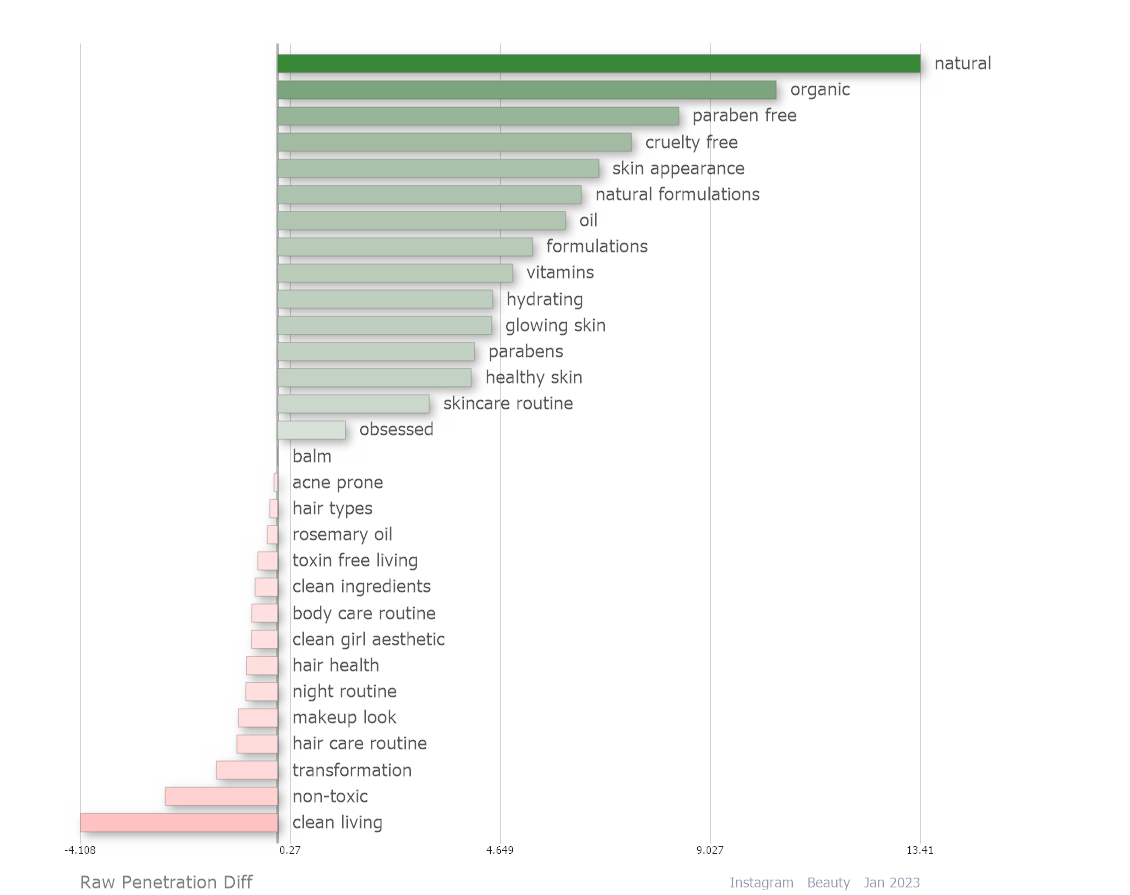

Cross Data Source Comparison

In a head-to-head comparison, the Clean Beauty category on Instagram appears more defined by skincare (specifically skincare results), while the category on TikTok might be more tied to clean living in general. Specifically, terms like skin appearance, glowing skin, and healthy skin skew towards Clean Beauty conversations on Instagram, while the category's conversations on TikTok are more likely to mention clean living, hair care routine, and makeup look. The topic seems to have a larger reach on TikTok, where Clean Beauty seems to permeate several aspects of consumers' lives.

| Key Topics Comparative Analysis - 'Clean Beauty' (Instagram - green) vs 'Clean Beauty' (TikTok - red) |

|

| X-axis: | Raw Penetration Diff % | How frequently was the topic mentioned in 'Clean Beauty' (IG - green) vs 'Clean Beauty' (TT - red) conversations - avg. over 3 months? | ||||

| Shading Color: | Raw Penetration Diff % | How frequently was the topic mentioned in 'Clean Beauty' (IG - green) vs 'Clean Beauty' (TT - red) conversations - avg. over 3 months? |

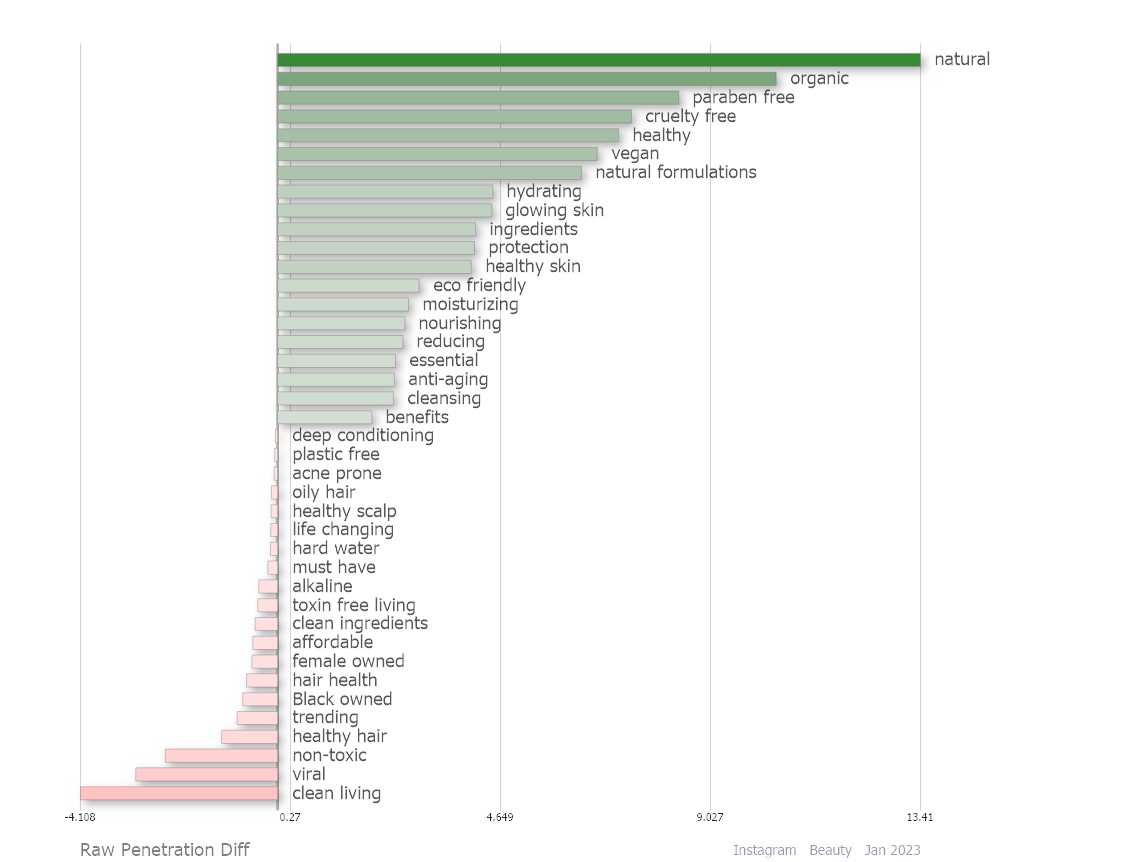

This distinction in the category definition between Instagram and TikTok is also evident in the different benefits and concerns defining the category on each platform. Instagram Clean Beauty conversations are likely to mention topics like hydrating and anti-aging. On TikTok, topics like non-toxic, hair health, and plastic free are more likely to be mentioned in Clean Beauty conversations.

| Benefits and Concerns Comparative Analysis - 'Clean Beauty' (Instagram - green) vs 'Clean Beauty' (TikTok - red) |

|

| X-axis: | Raw Penetration Diff % | How frequently was the topic mentioned in 'Clean Beauty' (IG - green) vs 'Clean Beauty' (TT - red) conversations - avg. over 3 months? | ||||

| Shading Color: | Raw Penetration Diff % | How frequently was the topic mentioned in 'Clean Beauty' (IG - green) vs 'Clean Beauty' (TT - red)conversations - avg. over 3 months? |

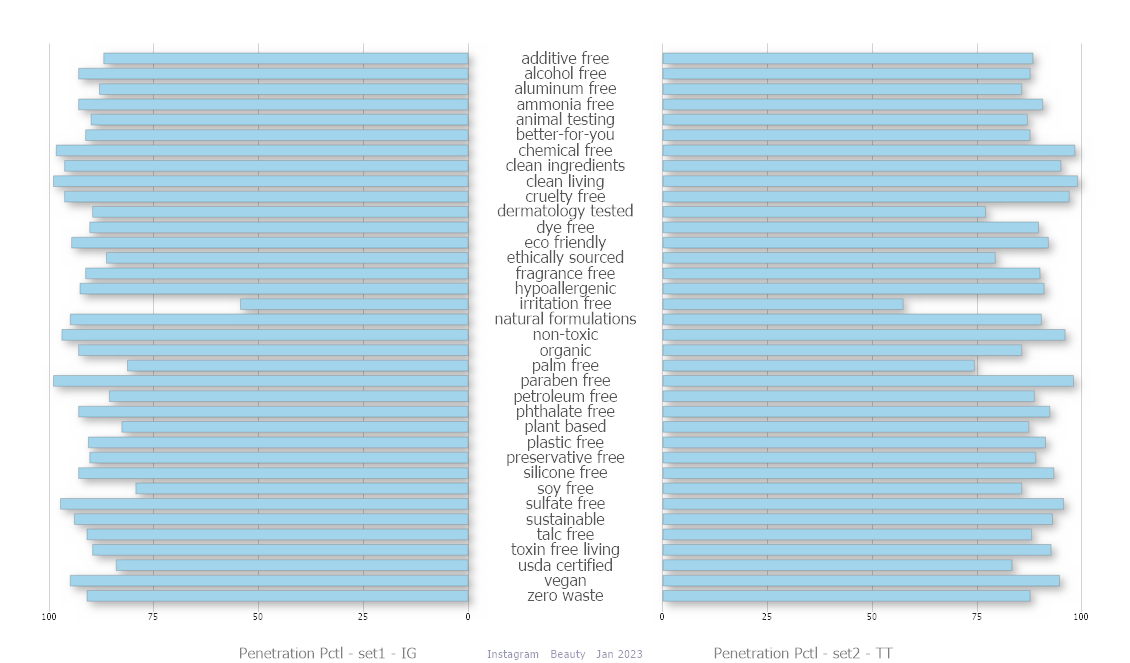

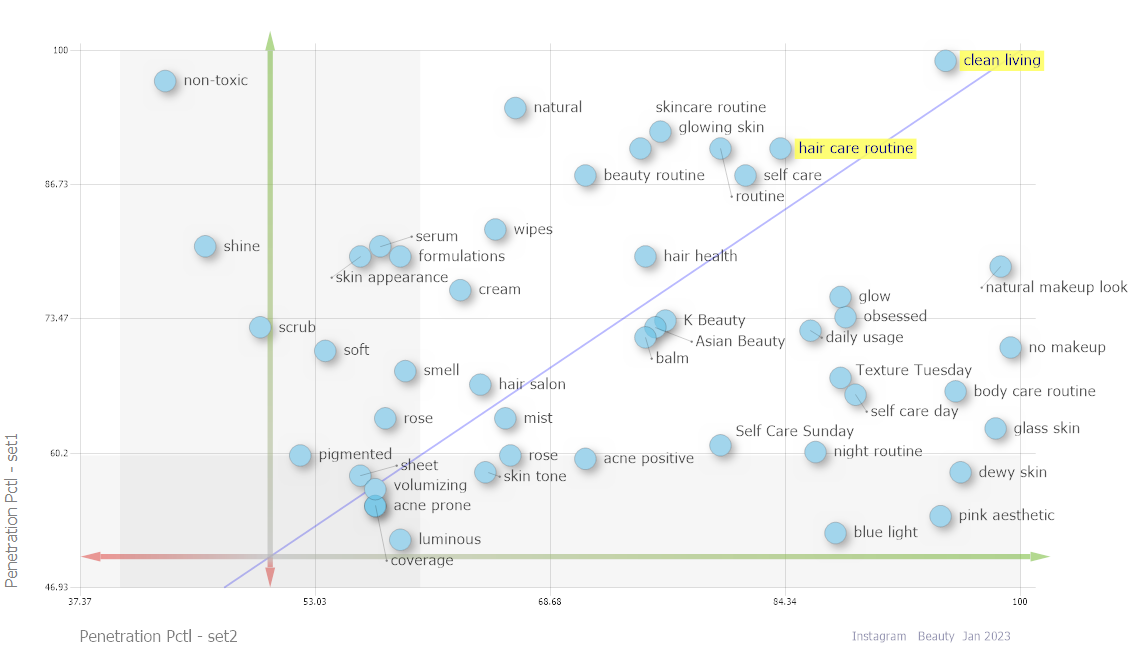

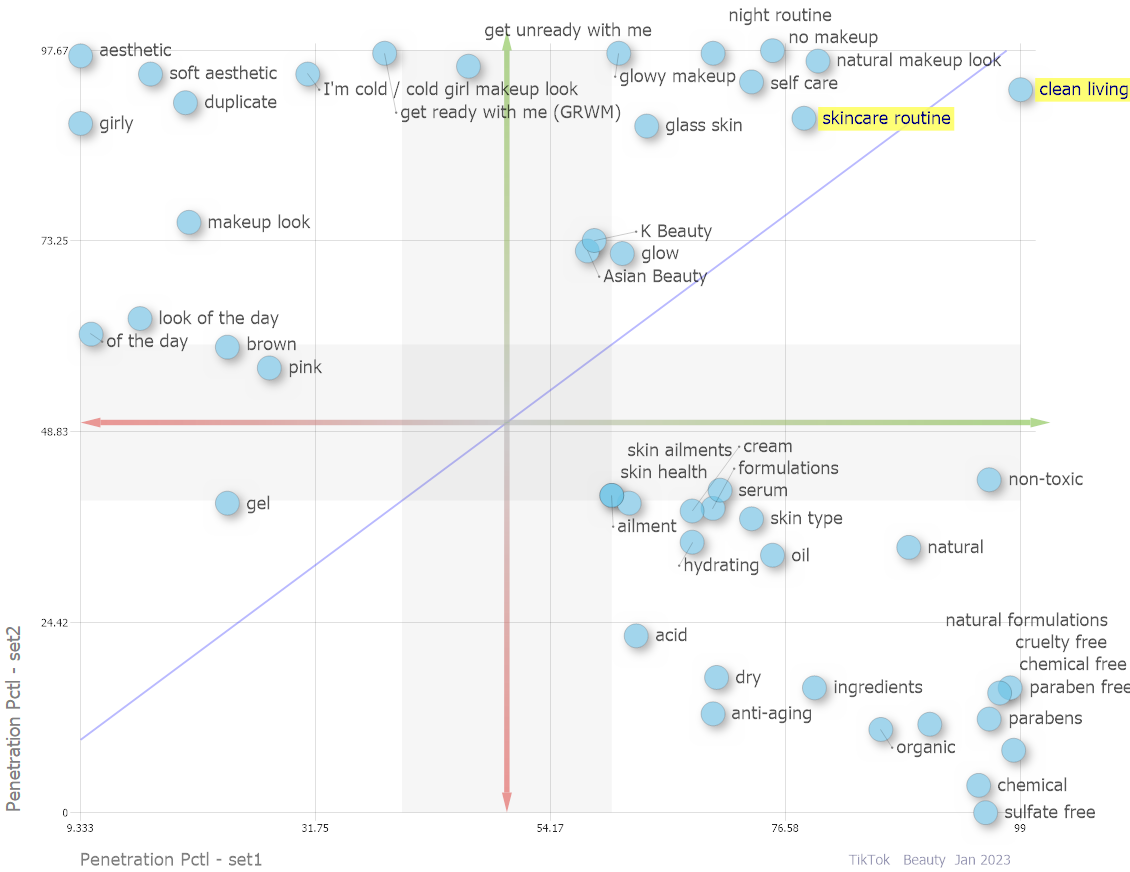

Qualities which industry leaders often use to define Clean Beauty appear consistent in their association to Clean Beauty across platforms. For example, clean living is the most significant topic of the set to Clean Beauty Instagram and TikTok posts, while irritation free is the least significant of the set across both platforms.

| Clean Beauty Defining Qualities Comparative Analysis - 'Clean Beauty' (Instagram - left) vs 'Clean Beauty' (TikTok - right) |

|

| Left Graph: | Penetration Pctl - set1 - IG (1-100) | Is the topic over or under represented in 'Clean Beauty' (Instagram) conversations relative to similarly categorized objects in Beauty - avg. over 3 months? | ||||

| Right Graph: | Penetration Pctl - set2 - TT (1-100) | Is the topic over or under represented in 'Clean Beauty' (TikTok) conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

Clean Girl Aesthetic

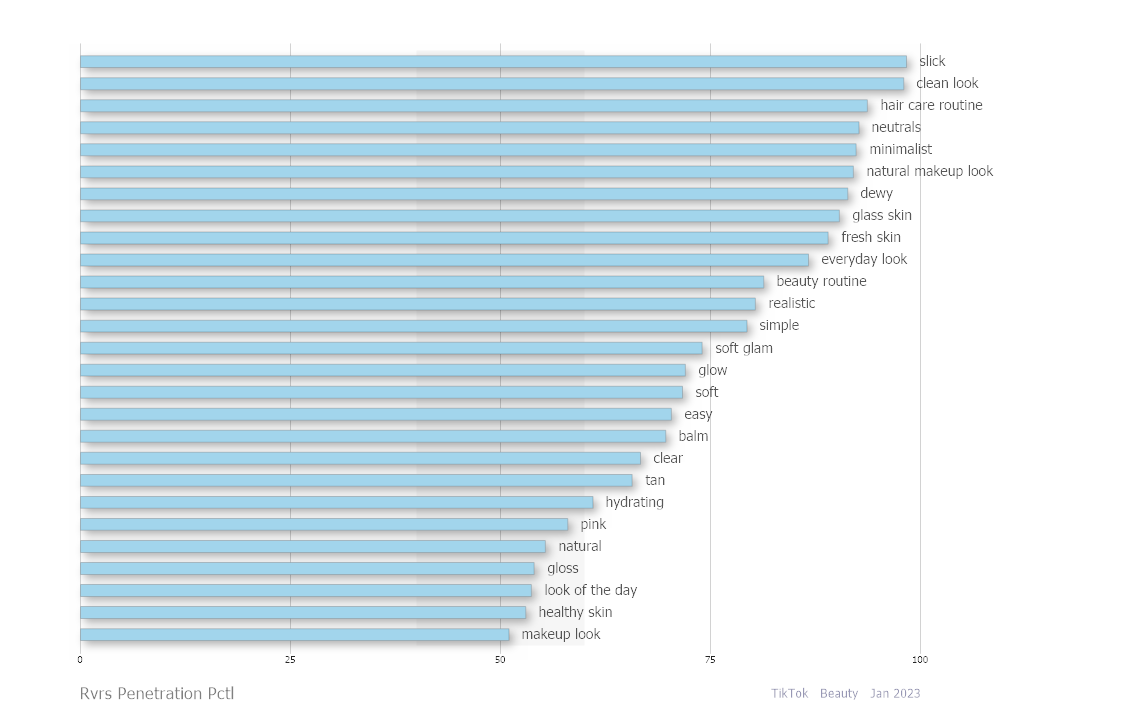

The clean girl aesthetic has made waves on TikTok in recent months, permeating the Beauty, Fashion, and Personal Care spaces. The idea is to look effortlessly gorgeous by leaning into a minimalist look that highlights shiny hair and glowing, flawless (yet natural appearing) skin.

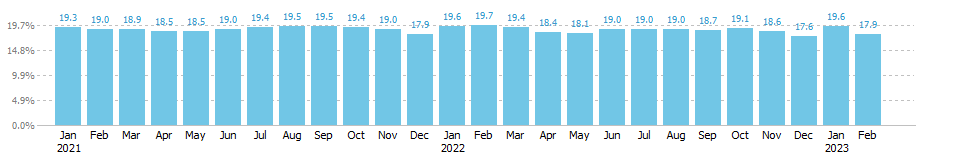

The clean girl aesthetic, after having found its footing on TikTok, has seen similar growth patterns in monthly activity across TikTok and Instagram. It's clear that the aesthetic has gained traction on both platforms, but just how much influence has it had on the Clean Beauty category on each platform as a result?

| Monthly Post Volume of 'clean girl aesthetic' on TikTok (blue) vs. Instagram (gray) |

|

The clean girl aesthetic is most significantly mentioned alongside terms like slick, natural makeup look, glass skin, and hydrating on TikTok. These terms are defining of this aesthetic, and appear to have areas of overlap with the Clean Beauty category.

| Topics Where 'clean girl aesthetic' is Significantly Mentioned - TikTok |

|

| X-axis: | Rvrs Penetration Pctl (1-100) | Relative to other topics in the Beauty, is clean girl aesthetic over or under represented in the topic's conversations - avg. over 3 months? |

On Instagram, there appears to be a large degree of overlap between the topics defining Clean Beauty and those defining the clean girl aesthetic. Most notably, however, is their almost equal significance to clean living and hair care routine. While Clean Beauty on the platform does seem to be intertwined with skincare and skincare results, Clean Beauty consumers subscribing to the clean girl aesthetic might be more interested in hair care specifically.

| Overlap Between 'Clean Beauty' and 'clean girl aesthetic' - Instagram |

|

| X-axis: | Penetration Pctl - set2 (1-100) | Is the topic over or under represented in 'clean girl aesthetic' conversations relative to similarly categorized objects in Beauty - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl - set1 (1-100) | Is the topic over or under represented in 'Clean Beauty' conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

Interestingly, the Clean Beauty consumer on TikTok who subscribes to the clean girl aesthetic has an identified interest in skincare specifically. In general, there appears to be less overlap between these two categories on TikTok.

| Overlap Between 'Clean Beauty' and 'clean girl aesthetic' - TikTok |

|

| X-axis: | Penetration Pctl - set1 (1-100) | Is the topic over or under represented in 'Clean Beauty' vs 'clean girl aesthetic' Comparative Analysis conversations relative to similarly categorized objects in Beauty - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl - set2 (1-100) | Is the topic over or under represented in 'Clean Beauty' vs 'clean girl aesthetic' Comparative Analysis conversations relative to similarly categorized objects in Beauty - avg. over 3 months? |

A smaller degree of overlap between Clean Beauty and the clean girl aesthetic on TikTok could be explained by a smaller amount of growth in co-occurrence on the platform compared to that on Instagram. In general, clean girl aesthetic conversations seem to be shifting from TikTok to Instagram, which could also explain this imbalance.

Although the aesthetic still skews towards Clean Beauty conversations on TikTok, the smaller degree of alignment between the categories could indicate that the aesthetic has larger influence over the category on Instagram, where its share is increasing at a faster rate.

| 'clean girl aesthetic' Share of 'Clean Beauty' Posts - Instagram |

|

| 'clean girl aesthetic' Share of 'Clean Beauty' Posts - TikTok |

|

Methodology & Appendix

Social Standards is a comparative analytics platform transforming billions of social data points into benchmarked insights about every brand, product, feature, and trend consumers talk about. Innovative brands and investors use our data to make strategic decisions around product development, competitive differentiation, investments, and M&A opportunities so they can get ahead and stay ahead of the competition.

|

if you have additional questions, please email

Appendix

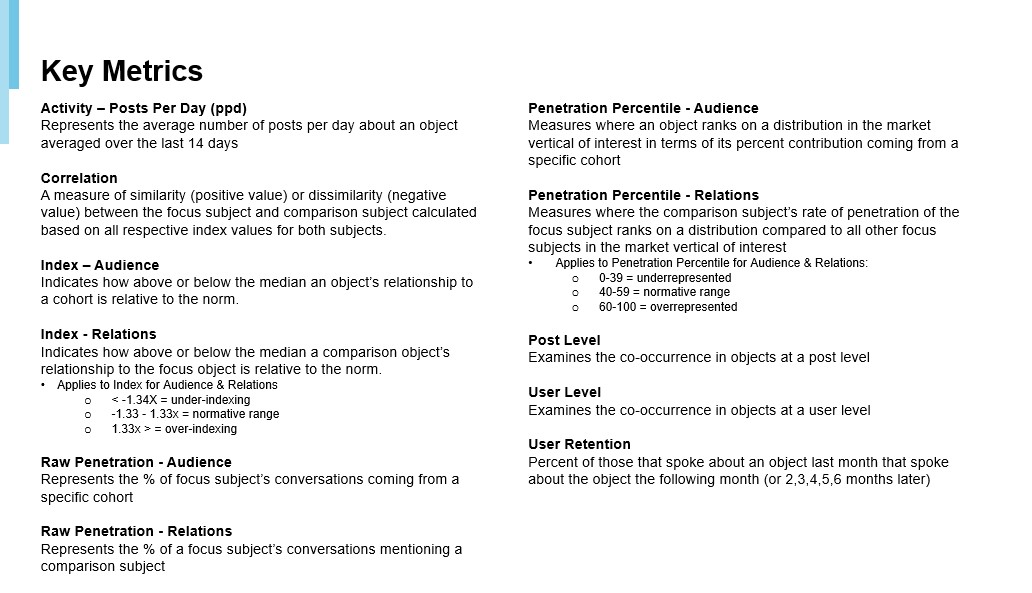

Key Metric Definitions

|

for additional metric definitions

2015-2023 © by Social Standards, Inc.

last updated on Apr 25, 2023

Object IDs successfully added to clipboard